MAGNA – US AD SPEND FORECAST – MARCH 2020 UPDATE

TEN KEY TAKEAWAYS

- In the unprecedented situation created by the coronavirus outbreak and the economic downturn, MAGNA is revising its media owners net advertising revenue (NAR) forecasts for 2020 and 2021.

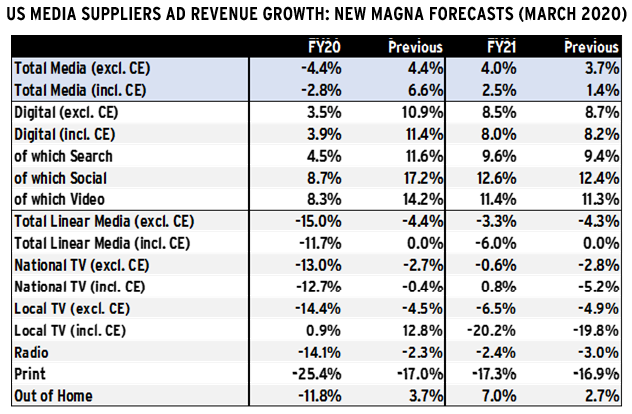

- MAGNA now expects media suppliers’ total linear ad sales to decline by -12% (-20% in the first half, -2.5% in the second half) while digital ad sales will be more resilient at +4% (-2% in the first half, +10% in the second half).

- Overall, all-media full year ad sales may decrease by -2.8% this year as the spending cut from most industry verticals will be mitigated by the incremental political spend ($4.9 billion, up +26% vs 2016), and a v-shaped rebound in the second half.

- For 2021, MAGNA increases its normalized (non-cyclical) advertising spending forecast (from +3.7% to +4.0%) and, due to the low comp, delayed consumption effects, and postponement of summer Olympics, the actual ad dollar growth will be higher than what we previously forecasted: +2.5% vs +1.4%.

- This new market scenario is based on MAGNA’s statistical model fueled by 40 years of data, and by the latest forecasts from macro-economists, who anticipate real GDP shrinking by -1% to -4% this year, compared to a forecast of +2% pre-coronavirus.

- At this stage, the total market decline anticipated (-3% or -$6.2bn vs 2019) remains less severe than the decline experienced in 2008-2009 (-20% or -$33bn vs 2007), mostly because of the weight and resilience of digital advertising today. However, at this stage, both the macro-economic outlook and the corresponding advertising forecast present a high degree of uncertainty and significant downside risk for 2020.

- The impact on business and marketing activity will vary across industries, depending on how much demand and investment will be delayed as opposed to destroyed during this crisis. MAGNA expects the impact to be severe for the travel, restaurant, and the theatrical movie industry, significant for retail, finance and automotive, moderate for packaged food, drinks, personal care, insurance and pharma, and potentially positive for ecommerce and home entertainment.

- Digital media ad sales will grow by +4% this year and re-accelerate to +7% next year. Search will slow down to +4.5% while social and digital video will continue to grow by high-single digits.

- Media vendors’ linear ad sales will shrink by -12% (incl. political) this year compared to approx. -4% per year in recent years. The decrease in advertising sales will reach -13% for national TV, -12% for OOH, -25% for print and -14% for radio. The outlook will be slightly more positive for broadcasters and publishers when including digital ad sales. Local TV’s non-political ad sales will also decline massively but political spending (almost $5bn, +26% vs 2016) will stabilize full year revenues (+1%).

- MAGNA analysis of brand performance in previous downturns (2001, 2008-2009) suggests that brands that were able to maintain advertising activity, or increase their share of voice during the crisis, outperformed the ones that “went dark” during the recovery.

Vincent Letang, EVP, Global Market Research, author of the report, commented:

“The current situation is totally unprecedented, but the closest historical equivalent would be a combination of the Great Recession and 9/11; a brutal economic downturn and a “Black Swan” national disaster. Its effects on supply, demand, and media consumption are more complex and widespread than in any ‘normal’ economic recession in the past, and some of them will outlast the current crisis. Nevertheless, there will be an “after”. At this stage, MAGNA anticipates ad market stabilization and rebound in the second half of 2020, and moderate growth in 2021”.

MAGNA continues to monitor the situation closely, in the US and in the 70 markets it is tracking. MAGNA will re-assess its 2020-2021 scenario early June based on the new epidemiologic and macro-economic outlook and the actual 1Q ad revenues revealed by the financial earnings of media companies. The full report and detailed dataset (2020-2024) is available to Mediabrands employees and clients, and MAGNA Intelligence subscribers.

“CE”: cyclical events (elections, Olympics)

ABOUT MAGNA

MAGNA is the centralized IPG Mediabrands resource that develops intelligence, investment and innovation strategies for agency teams and clients. We utilize our insights, forecasts and strategic relationships to provide clients with a competitive marketplace advantage.

MAGNA harnesses the aggregate power of all IPG media investments to create leverage in the market, negotiate preferred pricing and secure premium inventory to drive maximum value for our clients. The MAGNA Investment and Innovation teams architect go-to-market investment strategies across all channels including linear television, print, digital and programmatic on behalf of IPG clients. The team focuses on the use of emerging media opportunities, as well as data and technology-enabled solutions to drive optimal client performance and business results.

MAGNA Intelligence has set the industry standard for more than 60 years by predicting the future of media value. The MAGNA Intelligence team produces more than 40 annual reports on audience trends, media spend and market demand as well as ad effectiveness.

To access full reports and databases or to learn more about our subscription-based research services, contact [email protected].

Press contact: Zinnia Gill, [email protected]