Published on Branding In Asia

Search remains the largest portion of digital advertising revenues representing $101 billion in 2024 – making up 46% of total digital advertising budgets.

MAGNA’s winter update of its Global Ad Forecast reports that media owners’ advertising revenues reached $933 billion in 2024, reflecting a 10% increase, consistent with mid-year projections.

TMO ad sales were boosted by a record number of cyclical events (elections in the US, Mexico, and India, as well as the Summer Olympics, Football Euro, Copa America competitions) and a +12% growth in TMO’s non-linear ad sales (e.g. ad-supported streaming +18%).

Among the most dynamic ad markets this year are France and the US (both +12%), India and the UK (both +11%). Growth was more subdued in Japan and Canada (both +8%), China (+7%), Germany and Australia (both +6%). The US market remained the largest with $380 billion, ahead of China ($155bn).

“The strong growth of advertising spending in 2024, despite a challenging economic environment, was of course driven by an unusually high number of major cyclical events but, more fundamentally, media innovation is what attracts a growing share of marketing budgets into advertising formats,” said Vincent Létang, EVP, Global Market Research at MAGNA, and author of the report.

“Digital Pure-Play ad formats (Search, Retail Search, Social, and Short-Form Video) are fueled by the rise of Commerce Media redirecting billions of dollars from trade marketing into digital formats. The growing reach of ad-supported CTV streaming makes cross-platform long-form video more attractive to advertisers as it now offers scale on top of addressability and brand safety.

“With no major cyclical drivers in 2025, MAGNA expects ad spend growth rates to slow, but the organic factors will remain at work, stabilizing TMO ad revenues, and growing DPP ad sales.”

Focus on APAC

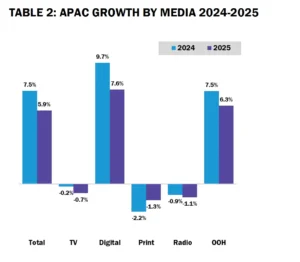

The advertising economy in Asia Pacific grew by +7.5% in 2024 to reach $289 billion. This is taking place in a slightly slowing, but stable, economic environment where real GDP grew by +5.3% in 2024 according to the IMF.

Overall APAC growth of +7.5% in 2024 consists of traditional media owners seeing +1.0% growth to reach $68 billion (24% of budgets), and digital pure player publishers seeing the growth of +9.7% to reach $221 billion (76% of budgets).

Television budgets are stabilizing in 2024 and are expected to be up by +0.1%. This increase in growth is primarily driven by the tailwinds of sporting events – primarily the Paris Olympics.

Digital advertising revenues are the driver of growth

Search remains the largest portion of digital advertising revenues and represented $101 billion in 2024. This is 46% of total digital advertising budgets.

Search advertising in APAC is substantially driven by retail media platforms, especially in China where Alibaba, JD.com, Pinduoduo, and Meituan all drive search advertising revenues.

Core search is also spiking around the world as traditional search platforms like Google and Baidu also see strong performance relative to recent results.

Social media advertising revenues also remain strong in 2024

Social media ad revenues grew by +15% in 2024 to reach $77 billion (35% of digital advertising budgets). Both search and social media revenues are driven by mobile devices.

Smartphones are not just the dominant way that most consumers access the internet; in many APAC markets, they are the only way consumers access the internet.

The digital strength driving APAC advertising revenues will translate to continued share gains for digital advertising revenues in APAC. Digital revenues will represent 82% of total budgets in 2029, up from 76% of total advertising revenues in 2024.

Source: Global Ad Forecast, MAGNA

MAGNA is also analyzing many APAC markets with a cross-platform view, where digital pure-player performance is split from the digital revenues of traditional broadcasters and publishers. In 2024, revenue from digital properties represented 11% of traditional publisher revenues in Japan, 18% in China, 31% in Australia, and 5% in India.

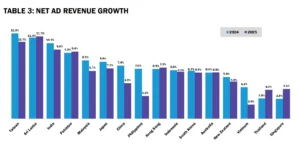

In 2024, the strongest growth in APAC came from Taiwan (+11.9%), Sri Lanka (+11.3%), and India (+10.5%). Weak advertising revenue growth, on the other hand, came from Singapore (+2.8%), Thailand (+2.8%), and Vietnam (+4.4%).

APAC as a region is still dominated by China, which represents more than half of total ad revenues. When combined with Japan, Australia, India, and South Korea, those five large markets represent 87% of total APAC revenues.

By 2029, the share of total revenues that are represented by linear advertising formats will have fallen to just 18%, representing about the same number of dollars ($66 billion) as they do today ($68 billion).

Source: Global Ad Forecast, MAGNA

“The APAC advertising market is thriving, growing by 7.5% in 2024 to reach $289 billion,” said Leigh Terry, CEO IPG Mediabrands APAC.

“This growth is fueled by digital advertising, with search and social media leading the charge. While traditional media is seeing modest growth, digital pure players are driving the majority of the market share.

“The future is bright for digital advertising in APAC, with its share of total budgets projected to reach 82% by 2029. Despite some economic uncertainties, the overall market remains stable and poised for continued growth.”