MAGNA ADVERTISING FORECASTS – DECEMBER 2023 UPDATE

KEY TAKEAWAYS

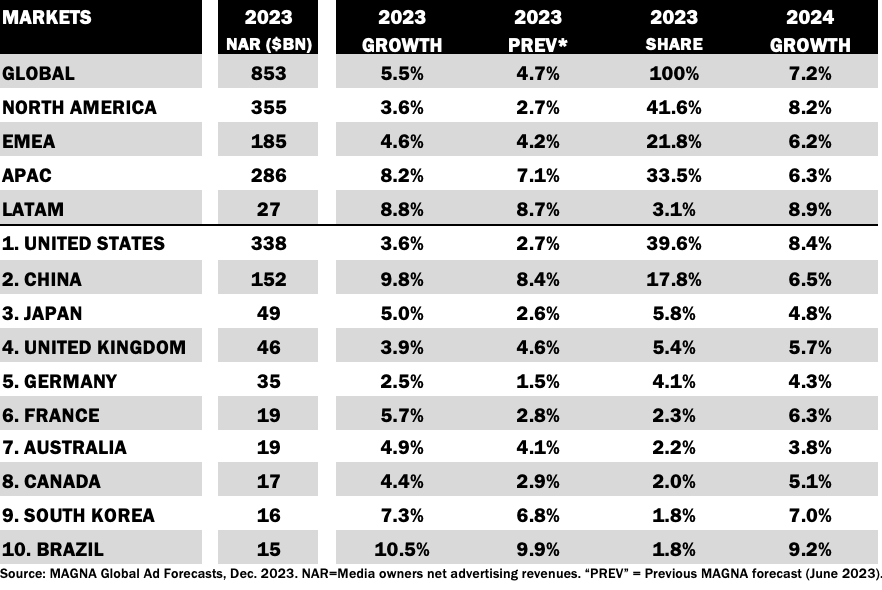

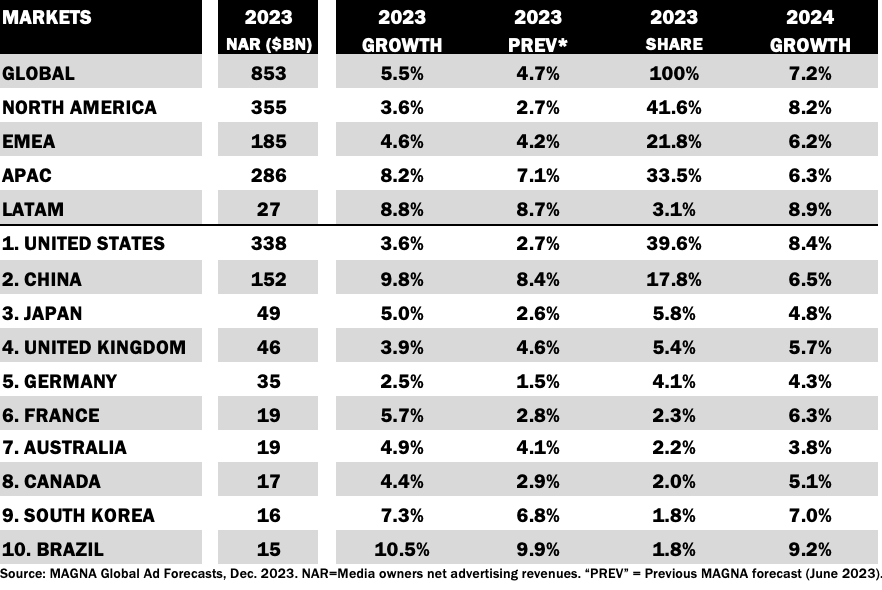

- The winter update of MAGNA’s “Global Ad Forecast” predicts that global media owners net advertising revenues (NAR) will reach $853 billion this year, +5.5% above the 2022 level, and will grow by +7.2% in 2024.

- Advertising spending accelerated and grew by +6.3% yoy in the second half of 2023 following a weaker first half (+4.7%) to average +5.5 growth full year.

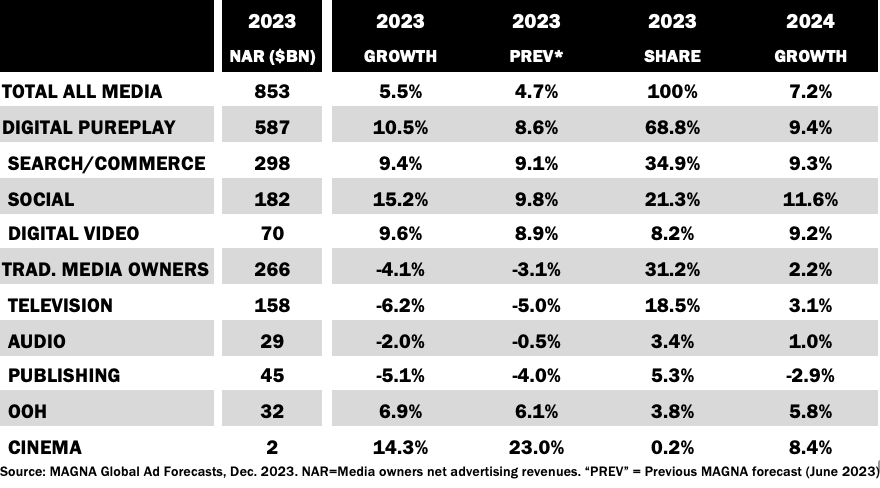

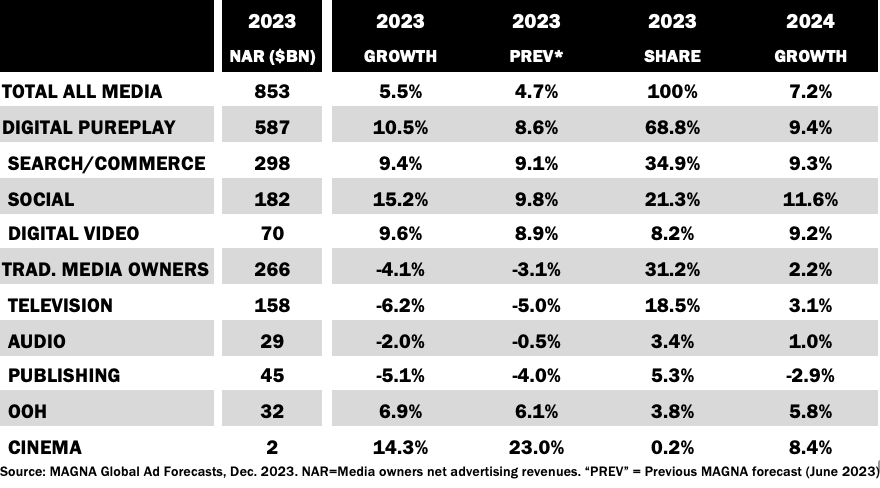

- Traditional media owners (TMO) from the TV, Audio, Publishing and OOH industries, are typically vulnerable during this slow, uncertain macro-economic climate, causing 2023 TMO ad revenues to shrink by -4% to $266bn.

- TV advertising revenues are shrinking by -6% this year to $158bn while Publishing ad sales drops by -5%, Audio Media drops by -2%, and Out-of-Home keeps growing by +7% to reach $32bn (back to pre-COVID market size).

- Digital Pure-Play media owners (DPP) ad revenue, on the other end, grew by +10.5% to $587bn (69% of total ad sales). DPP ad sales are driven by organic growth factors incl. the rise of ecommerce, retail media.

- Keyword Search remains the most popular ad format, approaching the $300bn milestone this year (+9% to $298 billion). Social Media owners (e.g., Meta, Tiktok) re-accelerate (+15% to $182bn), while short-form pure-play video platforms (e.g., Youtube, Twitch) grow by +9% to $70bn.

- The fastest-growing market this year is once again India (+12% to $14bn). China recovers from zero COVID (+9.8%) while Northern European markets slow down: UK +3.9%, Germany +2.5%.

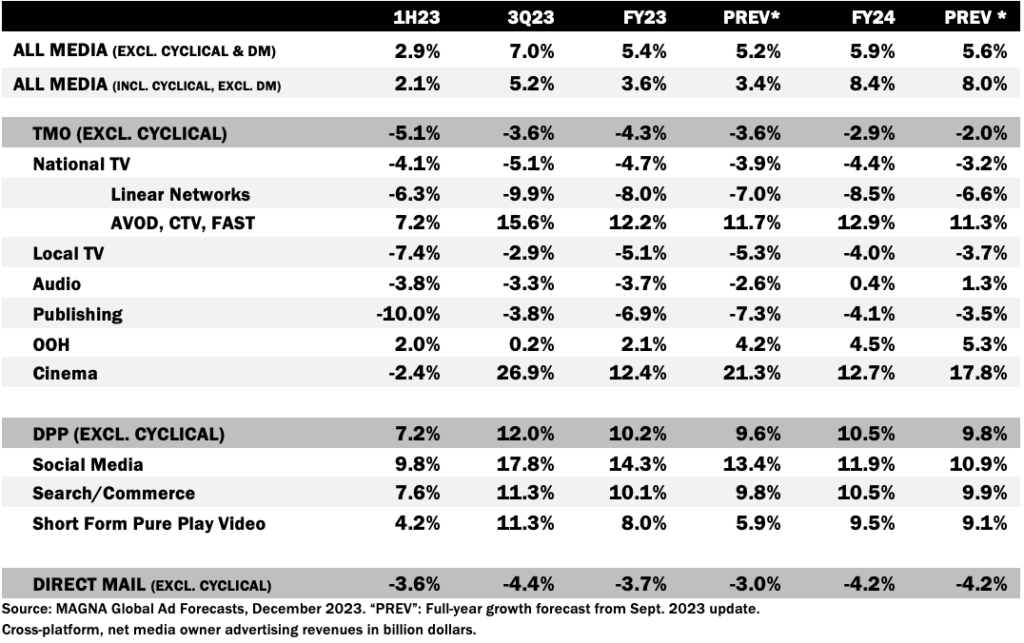

- The US market grew +3.6% to $338 billion this year (National TV -6%, Local TV -22%, Audio -4%, Publishing -7%, OOH +2%, Search +10%, Social +14%). Non-cyclical ad revenue is up +5.4% in 2023 and will accelerate to +5.9% in 2024 (+8.4% including cyclical ad spend – including almost $10 billion in political spending).

- In 2024, economic stabilization, lower inflation, digital innovation, and the return of major cyclical events (elections, international sports events) will drive ad spend +7.2% to $914 billion, +8.4% in the US. TMO ad revenues will recover by +2.2% while digital pure players ad sales will increase by +9.4%.

- Automotive, Travel, and Pharma will be among the fastest-growing ad spending verticals next year. CPG/FMCG brands will benefit from lower inflation, retail media opportunities and sports events. On the other hand, Entertainment marketing may suffer from the lower-than-usual volume of US shows and movies being released.

Vincent Létang, EVP, Global Market Research at MAGNA, and author of the report, said:

“As expected by MAGNA back in June, advertising spending re-accelerated in the second half of 2023 after four slow quarters from mid-22 to mid-23. The recovery is driven by easier year-over-year comps and stabilizing economic conditions (inflation slowdown), and these improvements mostly benefit pure-play digital advertising formats. Search formats are driven by retail media; Social and Video formats recover to double-digit growth thanks a better monetization of the fast-growing short vertical video impressions. Meanwhile traditional media owners’ ad revenues – including their digital ad sales – are down by -4% this year (TV -6%). The cyclical events of 2024 (sports, elections) will make reach media and contextual advertising attractive again and stabilize TMO ad revenues: overall +2%, TV +3%.”

The winter update of MAGNA’s “Global Ad Forecast” predicts media owners net advertising revenues (NAR) will reach $853 billion this year, growing +5.5% growth vs. 2022. 2023 ended up stronger than anticipated by MAGNA in its mid-year forecast update (June 2023: +4.6%) as second-half digital ad sales accelerated by +6.3% yoy following a weak first half (1Q23: +2%, 1H23: +4.7%) thanks to economic stabilization and easier comps.

MEDIA FORMATS

Traditional media owners (TMO) historically focusing on Television, Audio, Publishing, OOH, and cinema media, are typically the most exposed in an uncertain macro-economic and business climate, as some brands seek to reduce marketing budgets or prioritize performance-based digital ad formats. Global TMO ad revenues shrank by an estimated -4.1% to $266bn globally. This rate of erosion is similar to what was observed in the ten years pre-COVID.

The non-linear ad sales of TMOs (AVOD, podcasting, DOOH etc.) continue to grow steadily. They increased by +7% this year to reach 20% of total TMO ad revenues on average (11% for TV and premium streaming video, 44% of newspaper and magazine publishers, 23% of radio broadcasters), but this is not yet enough to offset the continued erosion of traditional linear ad formats (-6.3%).

The introduction of advertising on Amazon Prime Video will be a game changer for AVOD globally. Ads will first appear in January 2024 in the US, followed by Germany, Canada and the UK in the first half, and France, Italy, Spain, Mexico, and Australia later in the year. Amazon Prime will bringing massive scale and reach from day one as viewers (111 million monthly users in the US alone) will be will defaulted into the ad supported tier.

Despite the growth of digital ad sales, total television advertising revenues have been shrinking by -6% this year to $158 billion while Publishing ad sales dropped -5% to $45bn and Audio Media NAR was down -2% to $29bn. The only traditional media types to keep growing in 2023 are Out-of-Home, up +7% to reach $32bn (now above its pre-COVID market size), cinema (+14% to $1.9bn but still 35% smaller than pre-COVID).

Digital Pure-Play (DPP) ad formats (Search/Commerce, Social, Short-Form Video) grew by an estimated +10.5% to $587bn (69% of total ad sales). DPP ad sales are driven by several organic growth factors including the rise of ecommerce, retail media, digital media consumption, and stabilization in the data landscape after the restrictions suffered in 2021 and affecting the 2022 ad sales.

Search/commerce formats remain the most popular, approaching the $300bn milestone (+9% to $298 billion). Social Media ad sales (e.g., Meta, Tiktok) re-accelerate strongly (+15% to $182bn) after stagnating for most of 2022, while short-form pure-play video platforms (e.g., Youtube, Twitch) grow by +9% to $70bn. Social and Pure-Play Video platforms both benefit from better monetization of the rapidly growing short vertical video formats.

Retail Media Networks generated $124 billion of ad revenues globally in 2023 ($43 billion in the US). This represents 15% of global advertising revenues. Most of it (87%) goes into keyword search-based formats, and Retail Media represents 23% of total search advertising revenues outside of China. MAGNA predicts global Retail Media Network (run by ecommerce platforms like Amazon or traditional retailers like Walmart) to grow ad revenues by +20% outside of China.

MARKETS

Looking at key markets, the strongest growth this year comes once again from India (+12% to $14bn), that becomes the 11th largest ad market globally. China (second-largest market) recovers faster than expected from the stagnation caused by zero-COVID in 2021-22 (+9.8%). At the other end, Northern European markets underperform due to sluggish economic activity: UK (#4) +3.9%, Germany (#5) +2.5% with TMO ad revenues down heavily in both markets. For once, Southern Europe shows more resilience this year, including France (#6, +5.7%), Italy (#12, +5.8%), and Spain (#14, +7.8%).

In the US, media owners NAR increased by +3.6% to $338 billion (National TV -6%, Local TV -22%, Audio -4%, Publishing -7%, OOH +2%, Search +10%, Social +14%). Excluding cyclical ad spend (elections, global sports events), NAR is up +5.4% in 2023 and will accelerate to +5.9% in 2024 (+8.4% including cyclical events).

In 2024, economic stabilization, lower inflation, and the return of major cyclical events (US elections, Paris Olympics, Euro Football) will drive ad spend +7.2% to $913 billion, +8.4% in the US. TMO ad revenues will recover by +2.2% while digital pure players ad sales will increase by +9.4%.

ADVERTISERS

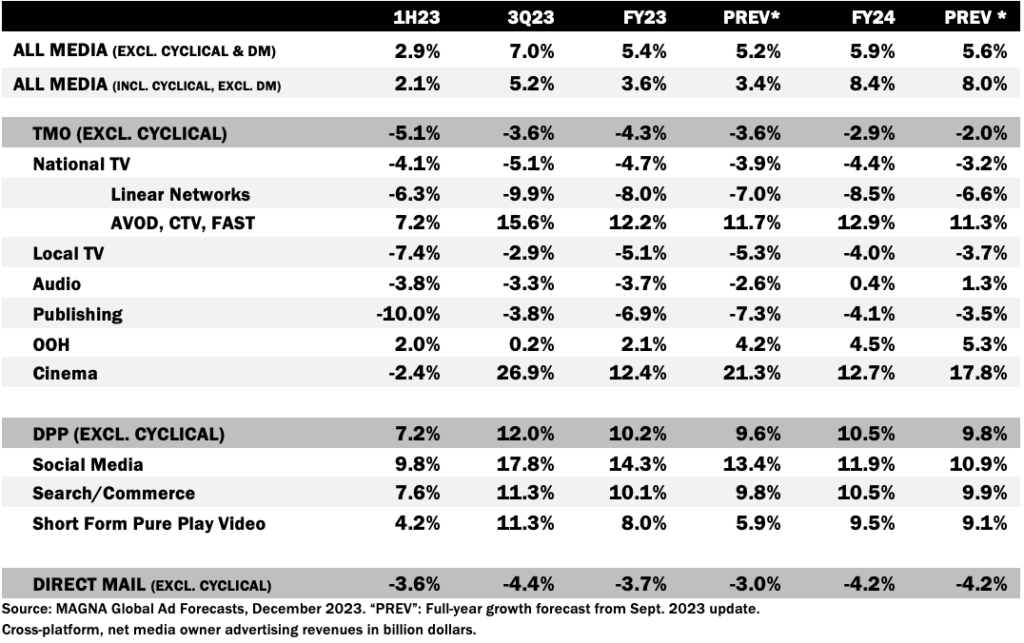

Automotive and Travel were, as expected the most dynamic industry verticals in 2023. In both cases a supply-driven business cycle trumps consumer anxiety (which would normally hurt big ticket items and discretionary services). Auto ad spend was up almost everywhere this year, except in the US, but MAGNA predicts the US will join the growth club in 2024 as the electrical transition spurs competition between old and new brands (and now Chinese brands in Europe) and electric cars are increasingly affordable in every market segment. CPG/FMCG brands will benefit from lower inflation, retail media opportunities, and the 2024 sports events (Food, Drinks).

Pharma marketing continues to grow organically driven by population ageing, competition, and innovation (major new drugs being launched for Cancer, COVID, Mental Health, etc.). Government/Political advertising will grow due to general elections taking place in three major countries among the few where political campaigns are allowed on television: Mexico, India, and the US.

On the other end, Media & Entertainment marketing activity could benefit from the launch of yet another ad-supported tier from a major streaming platform (Amazon Prime) but will suffer from the lower-than-usual volume of US shows and movies being released in 2024 due the Hollywood strikes in 2023 (the actors’ strike lasted from July to November). Betting brands would normally benefit from more sports events, but the regulatory pendulum has now switched back to tightening in Europe (Italy, Spain, Netherlands) and the Betting industry engages in voluntary moderation where it’s still allowed to advertise.

MEDIA OWNERS

Media Vendor Concentration Grows Again. After stagnating for several quarters, the global advertising sales of Google, Meta and Alibaba re-accelerated since 2Q23 to reach a year-to-date 1Q-3Q growth of +4%, +13% and +5% respectively.

These three media owners account for a combined 49% of global advertising revenues. Outside China, the top three vendors are Google, Meta, and Amazon, capturing 80% to 90% of digital ad spend and 56% of total ad spend (the market share being lower for national consumer brands higher for small, local, direct advertisers).

Among the world’s top 20 vendors, Amazon, Bytedance and Apple posted the strongest growth over the first nine months (between 20% and 23% each), while the traditional media companies all reported heavy revenue declines: Comcast, Disney and Warner ad revenues shrank by -14% to -15% while Discovery and RTL Group lost -7% to -8%.

KEY FIGURES

TABLE 1: US AD FORECAST

TABLE 2: INDUSTRY VERTICALS

GLOBAL AD SPENDING DYNAMIC 2024

KEY FIGURES

TABLE 3: GLOBAL FORECAST BY MARKET

TABLE 4: GLOBAL FORECAST BY MEDIA

ABOUT THE RESEARCH

The MAGNA market research is media centric. It estimates net media owners advertising revenues based on an analysis of financial reports and data from local trade organizations; other ad market studies are based on tracking ad insertions or consolidating agency billings. The MAGNA approach provides the most accurate and comprehensive picture of the market as it captures total net media owners’ ad revenues coming from national consumer brands’ spending as well as small, local, “direct” advertisers. Forecasts are based on economic outlook and market shares dynamic. The full Ad Forecast report (80 pages) and dataset contains more granular media breakdowns and forecasts to 2028, for 70 markets.

Next Global Forecast: June 2024 – Next US Forecast: March 2024.

ABOUT MAGNA

MAGNA is the leading global media investment and intelligence company. Our trusted insights, proprietary trials offerings, industry-leading negotiation and unparalleled consultative solutions deliver an actionable marketplace advantage for our clients and subscribers.

We are a team of experts driven by results, integrity, and inquisitiveness. We operate across five key competencies, supporting clients and cross-functional teams through partnership, education, accountability, connectivity, and enablement. For more information, please visit our website: https://magnaglobal.com/and follow us on LinkedIn.

MAGNA has set the industry standard for more than 60 years by predicting the future of media value. We publish more than 50 reports per year on media and advertising market trends.

To access full reports and databases or to learn more about our market research services, contact [email protected].