And that’s the good news, according to a Magna Global report, as the crisis hammers spending across all formats.

Global digital advertising is likely to slow down to single-digit growth this year, compared to over 20% per year in recent years, according to a new report from Magna, the centralised IPG Mediabrands resource. However, digital media will likely be the least impacted form of media during the crisis, due to the acceleration of digital media usage and ecommerce during the outbreak.

According to Magna’s report, among linear ad formats, TV will remain relatively resilient due to pre-existing spending commitments and the fact that its core CPG/FMCG clients will be relatively unscathed by the outbreak and the economic slowdown. While TV viewing is reportedly growing as people isolate at home, a shortage of fresh programming and the cancellation of live sports events may ultimately limit overall growth, Magna says.

Radio ad sales may suffer more, as automotive commuting stops for weeks, and OOH media sales will be severely hurt during the outbreak as train stations and highways remain empty. OOH media may recover faster than other media, however, due to its strong performance and client mix (technology).

Early data from China, South Korea and Italy suggests significant increases in TV viewing and digital media consumption.

When WFH rules and quarantines are established on a national scale, linear TV viewing increases over 10% while the audience for news programs and news channels grows by 30% or more. Digital media consumption, especially social media and digital video, also increases by up to 10%, Magna data shows.

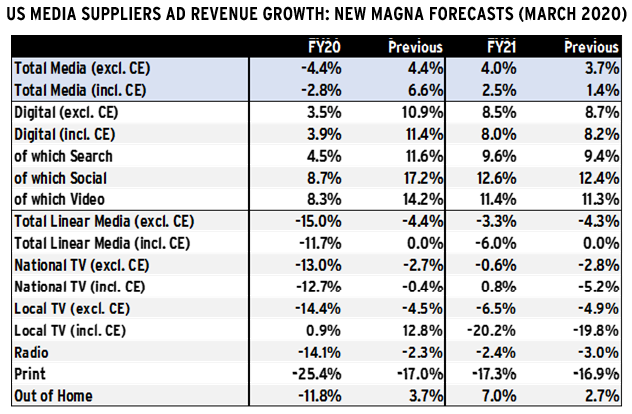

Meanwhile, in terms of demand, the agency says it will update its detailed media owners’ Net Advertising Revenues (NAR) forecasts in early June based on media companies Q1 earning reports to be published in April, and reports from local trade organisations. This will also give Magna a clearer outlook on the pandemic and the economic outlook.

Elsewhere, the report report contends that the quarantine and social distancing policies are generating changes in attitudes, social norms (remote work, remote education), consumption (acceleration of e-commerce and online services), and media consumption (surge in TV viewing, OTT usage, and digital media). These shifts are likely to (at least partially) outlast the outbreak.

With COVID-19 now a global pandemic, many industry sectors may decrease marketing and advertising spending this year as a result of slower sales and profits. Magna expects the impact on revenues to be severe for the hospitality sector, moderate for retail and automotive, mild for consumer goods and potentially positive for ecommerce and SVOD.

Magna has made a four-tiered forecast for adspend. The most severe cutbacks, the agency says, will be sectors such as travel, cinemas and other related leisure services, which will see demand for their offerings crumple to zero or near zero and many businesses go under.

The second “significant” category, which will see a strong slowdown and a decent recovery, includes retail (mild impact for grocery shops, severe for department stores, positive for ecommerce) and automotive and beauty businesses. Mildly hit businesses include technology, telecoms, pharma, food, drinks and personal care.

On the other hand, some categories will see positive growth in ad spending. These include household goods (some toiletries are seeing a temporary surge in sales), home entertainment (SVOD, OTT), e-commerce and delivery services and cloud computing services.

While the COVID-19 epidemic seems to be slowing in China, which shows that extreme isolation works and curbs the contagion within four to six weeks. Europe and North America are now facing at least five weeks of quarantines and business closures that will hit the economy, before business gradually comes back to normal.

For marketers, this means they are looking at a global recession in the first half (negative GDP growth in Q1 and Q2) to be followed by a recovery in the second half. If so, the global economy may stagnate in 2020, instead of growing by 3% as previously expected.

However, in terms of consumer sentiment, COVID-19 may have significantly accelerated the decline of several economies. Western Europe, where the economy was already slowing down before the outbreak, especially in Western Europe. China has already experienced negative growth in the first quarter for the first time in 40 years, and full-year growth is now expected to be between 3% and 5%, compared to 7% in recent years, prompting muted forecasts there and worldwide.