TEN TAKEAWAYS

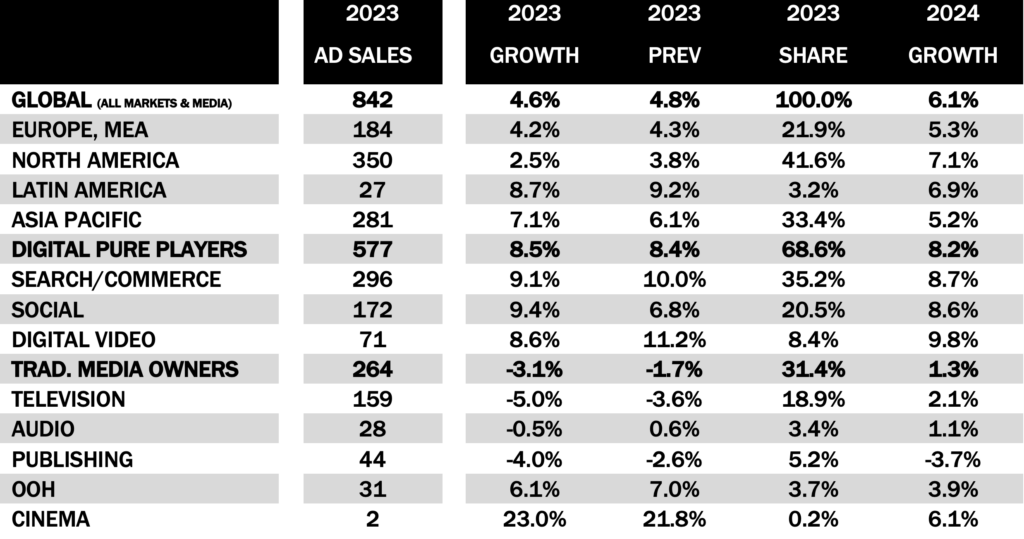

- The summer update of MAGNA’s “Global Ad Forecast” predicts media owners advertising revenues will reach $842 billion this year, +4.6% growth vs. 2022 ($805bn).

- This 2023 growth forecast is just 0.2 percentage points below MAGNA’s previous forecast (Dec. 2022: +4.8%) as the deterioration of economic conditions and marketing spending in most Western markets is mitigated by stronger-than-expected growth in some markets (China, Spain), industry verticals (Retail) and media types (Retail, Social).

- Several industry verticals show counter-cyclical patterns in their marketing dynamic. Some are expected to grow strongly, in line with business recovery (Automotive, Travel), some are not necessarily expected (Retail) to grow. CPG/FMCG product categories are ramping up their spending with Search and Retail Media Networks, partly at the expense of traditional branding media, but mostly by reallocating trade marketing budgets, thus bringing new money in the advertising ecosystem.

- Traditional media companies and branding formats (Television, Audio, Publishing, OOH, Cinema) are most exposed in this uncertain business climate, as some brands reduce marketing budget or prioritize performance-based digital ad formats. Global ad revenues across traditional categories in aggregate will thus shrink by -3% to $264 billion.

- Global television advertising revenues will shrink by -5% this year to $159 billion while Publishing ad sales will drop -4% to $44bn. Audio Media ad revenues will be stable (-0.5% to $28bn). The only traditional media categories to grow will be Out-of-Home, up +5% to reach $31 billion (catching up with pre-COVID market size), cinema (up 23% to $2 billion).

- Meanwhile, digital pure-play advertising sales will grow by +8.5% to reach $577 billion dollars i.e., 69% of total ad sales, driven by organic growth factors (ecommerce, retail media, media consumption shifts, stabilization in the data landscape). Search/commerce formats remain the largest ad formats, approaching the $300bn milestone (+9.1% to $296 billion). Social media formats re-accelerate by +9.4% to $172 billion, while short-form pure-play video advertising grows by +8.6% to $71 billion.

- Retail Media Networks are expected to generate $121 billion in advertising sales this year (+12%), most of it in the form of product search and ecommerce sponsorship. The bulk of these ad sales will come from ecommerce pure players, but traditional retailers are developing their media capabilities and their advertising sales will grow by +24% to reach $21 billion.

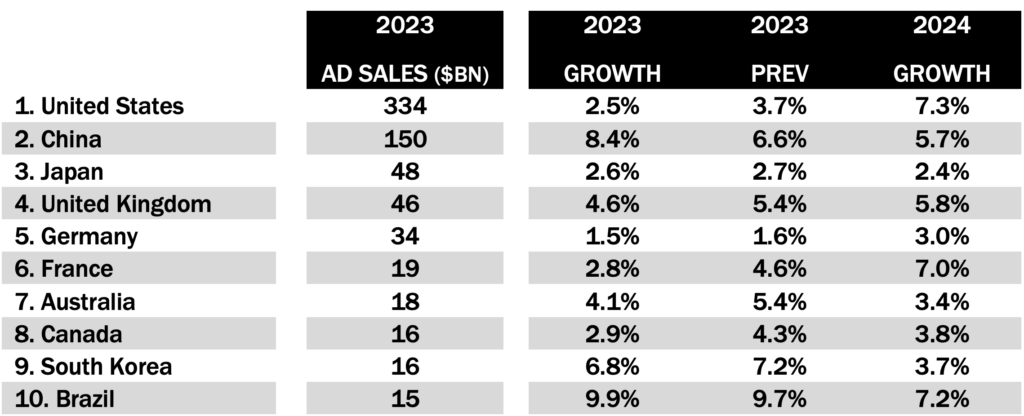

- The strongest ad growth rate this year will come once again from India (+12.3% to $12.6bn); India is the 11th largest market. The Chinese ad market is set to recover faster than previously expected (+8.4%). At the other end of the spectrum, most Western European markets will stagnate this year: Germany, France, Italy all below +3% growth all-media, and negative for traditional media owners.

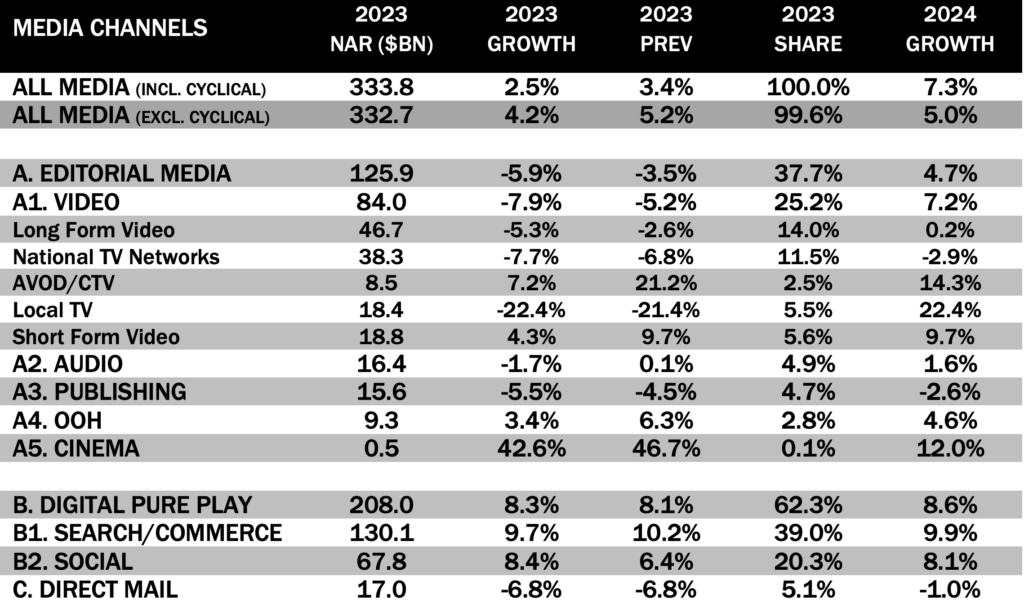

- In the US, media owners advertising revenues will increase by just +2.5% to $333 billion this year (cross-platform video -8%, Audio -2%, Publishing -6%, OOH +3%, Search/Commerce +10%, Social +8%, Direct Mail -7%). Ad spend stagnated in 4Q22 and 1Q23 but will likely accelerate as comps become much easier in the second half of the year.

- In 2024, economic stabilization and the return of major cyclical events (US presidential elections, Paris Olympics, Euro Football championship) will re-accelerate ad spend: +6.1% to $892 billion globally, +7.3% in the US. Traditional media owners’ ad revenues will recover by +1% while digital pure players ad sales will increase by +8%.

Vincent Létang, EVP, Global Market Research at MAGNA, and author of the report, said:

Advertising spending slowed down to a halt in the first quarter of 2023 (+1.5% globally, flat in most Western markets) due to economic uncertainty and the lack of cyclical drivers. There are, however, some drivers mitigating the impact of economic slowdown: Ecommerce and Retail Media bringing more marketing dollars into digital advertising formats, and the counter-cyclical dynamic of some large industry verticals (Retail, Auto, Travel). On balance, MAGNA expects the global marketplace to keep growing this year, as it managed to do during the brutal COVID recession of 2020. But of course – like in 2020 – traditional media formats and mature markets will struggle this year. Innovation keeps the market moving, however: traditional media owners are developing cross-platform capabilities and brand-safe addressable solutions that are increasingly attractive to brands, and now account for 19% of their advertising revenues.

MEDIA FORMATS

TV STRUGGLES, OOH RECOVERS, SOCIAL RE-ACCELERATES, RETAIL MEDIA TAKES OFF

Traditional, editorial media companies and branding formats (Television, Audio, Publishing, OOH, Cinema) are typically more vulnerable in economic downturns and uncertain business climates, when brands are tempted to reduce marketing budgets or prioritize performance-based digital ad formats over high-funnel branding channels. In that environment, the advertising revenues of traditional media owners will shrink by -3% this year, to $264 billion (31% of total ad sales).

Television advertising revenues (cross-platform long-form video ad sales) will shrink by -5% this year to $159 billion. Television broadcasters are hit by continued erosion in live linear viewing and rating supply (averaging

-10% in 2022), a slowdown in pricing conditions (CPM inflation set to average +8% vs. +13% in 2022) and a lack of cyclical events following the record cyclical spending of 2022 (FIFA World Cup, US & Brazilian Elections). Their “digital” non-conventional ad sales (e.g., addressable linear campaigns and AVOD pre-rolls on connected TVs) keep growing, however. In 2022 they accounted for an average 12% of total advertising revenues for broadcasters in top markets (US and UK around 15%, Germany 9%, France 7%, Japan 2%). Broadcasters’ non-linear revenues grew by +10% to +20% across key markets last year but they are slowing down in first half of 2023, and in any case the scale does not compensate for the erosion of linear ad sales (for now).

Elsewhere cross-platform print publisher ad sales will drop -4% to $44bn. Audio Media ad revenues will be stable, as digital audio growth offsets the erosion of radio ad sales (-0.5% to $28bn). The only traditional media categories to grow in 2023 will be Out-of-Home, up +5% to $31.3 billion, thus catching up with pre-COVID market size. Cinema advertising will continue its post-COVID recovery, up +23% to $2 billion, but the market remains 30% below the pre-COVID levels.

Meanwhile, digital pure-play advertising sales will grow by +8.5% to reach $577 billion dollars i.e., 69% of total ad sales, driven by organic growth factors (ecommerce, retail media, media consumption shifts, stabilization in the data landscape).

Search/commerce will remain the largest ad format, approaching the $300bn milestone (+9.1% to $296 billion). Within Search/Commerce, Commerce/Retail players will grow ad sales by 12% this year (to $121 billion) i.e., faster than traditional Search Engine companies like Google or Baidu. Within Commerce/Retail players, ecommerce specialists like Amazon or Alibaba are by far the most developed (83% of the segment) but traditional retail chains like Walmart or Carrefour are leveraging first-party consumer data to attract CPG brands into spending on their retail media networks or third-party media partners. Traditional retailers will grow Search-like ad revenues by +24% this year to $21 billion.

Social media formats will re-accelerate by +9.4% this year reach to $172 billion. The industry seems to have turned a corner in 1Q23 when Meta reported a return to YOY growth on an FX-adjusted basis after two consecutive quarters of flat or negative growth. Meta and other established social media vendors seem to have finally recovered from the loss of workable consumer data in the Apple ecosystem since late 2021, and they are making inroads in the monetization of the short vertical videos that have completely changed the user experience, challenging ad optimization, in less than two years. Finally pure-play short form digital video (instream platforms like YouTube or Twitch, plus outstream networks) will grow ad sales by +8.6% to $71 billion this year.

MARKETS

CHINA RECOVERS, EUROPE STRUGGLES, US HOLD, INDIA CRUISES

After record post-COVID growth in 2021 (+23%), ad spend started to slow down in the second half of 2022, and it was almost flat in the first quarter of 2023 (+1%) but it was against very strong first quarter growth in 2022. As comps gets much easier to match in the second half, MAGNA believes quarterly growth rate will improve to provide a full-year market growth +4.6%. Around that average, however, MAGNA anticipates a wide range of performances depending local economic performance and market maturity.

North America and European markets will underperform this year (ad market growth of +2.5% and +4.2% resp.), due to weaker economic activity (+1.6% and +0.8% real GDP growth, resp), mature media/marketing landscapes, and a lack of major cyclical driver compared to 2022. APAC (+7.1%) and Latin America (+8.7%) will grow significantly faster.

The strongest ad market growth rate this year will come, once again, from India (+12%). India becomes the largest nation on earth this year in terms of population, edging China, and is the 11th largest advertising market globally. The Indian market is still under-developed, as ad spend per capita stands at a mere $9 per year compared to $106 in China and $1,000 in the US. With economic development, media access and the rise of a huge middle, India is bound to crash the top 10 club within three years.

Meanwhile, the Chinese ad market recovers faster than originally expected, after stalling in 2022, following the repeal of the “zero COVID” policy towards the end of last year. IMF raised the China GDP growth forecast from +3.2% to +5.2%, and ad spend already grew by +6% YOY in the first quarter. MAGNA raises its full-year growth forecast to +8.4%. At the other end of the spectrum, most of Western Europe will stagnate (between 0% and 3% growth) (disproportionately hit by global economic slowdown and inflation) under +2% all-media, negative for traditional media).

In the US, media owners advertising revenues will increase by just +2.5% to $333 billion this year (cross-platform video -8%, Audio -2%, Publishing -6%, OOH +3%, Search/Commerce +10%, Social +8%, Direct Mail -7%). Ad spend stagnated in 4Q22 and 1Q23 but will likely accelerate as comps become much easier in the second half of the year, to reach +2.5% for the year, or +4.2% for non-cyclical ad spend (excluding political and Olympic spending).

Elsewhere MAGNA expects moderate market growth in Australia (+4.1%) and the UK (+4.6%), and little or no growth in France (+2.8%) Japan (+2.6%) and Germany (+1.5%).

Looking at 2024, economic stabilization, lower inflation, and the return of major cyclical events (US presidential elections, Paris Olympics, Euro Football championship) will re-accelerate ad spend: +6.1% to $892 billion globally. It will help the mature markets of North America and Europe in particular (US and France +7%, UK +6%) while Asian market will continue to grow strongly (India +12.5%, China +6%).

INDUSTRY VERTICALS

THE AUTO COMEBACK, THE RETAIL WAR, THE CPG DILEMMA

During economic downturns, big-ticket and/or discretionary goods and services are typically struggling while essential services and goods (health, utility, insurance, food) are less impacted. The current downturn is different and more complex for three reasons. High inflation, especially on food and drink products, is a new challenge on CPG brands and food retailers. Second, unemployment remains low so far in this downturn, which keeps

consumption of big-ticket items strong. Third, two big discretionary verticals happen to be recovering from the COVID and supply chain crises later than others, and currently experience the business cycle opposite to most other industries: Travel and Automotive.

Vacations and new cars are big, discretionary expenses that could be easily discarded or postponed by consumers when confidence is low and interest rates are high, but millions of families have already postponed vacations, or the renewal of their family car, sometimes for years, so now that there are no more physical obstacles to their plans, consumers are back in the market. As a result, we are seeing these two highly competitive industries growing marketing spending by more than +10% in most markets so far this year.

Many verticals experience struggling sales and show stagnating or declining marketing spending, just as previously expected: Tech/Telecoms, Finance (except in some markets like Germany where high interest rates are reviving competition between investment and saving products), Restaurants. On the other hand, some industry verticals prove more dynamic than originally expected. Grocery retailers, for instance, are ramping up ad campaigns in markets like Germany, France, and the UK, in a fierce battle for share of voice. Competition is being spurred by the realization that inflation-wary consumers are shopping around every weekend for the best deals, moving away from any pre-inflation loyalty to specific retail chains. One large vertical is showing a disappointing momentum so far this year: Entertainment. With moviegoers returning and streaming going mainstream, MAGNA was expecting the blockbuster releases and streaming competition to flare this year. But movie studios and streaming platforms have been relatively quiet in the first few months. MAGNA still expects the entertainment brands to resume the fight for market share at some point in 2023 or 2024, in the wake of re-brandings (e.g., “Max”), and the launch of new ad-supported tiers (Netflix, Disney+, possibly Prime or Apple).

Betting was the fastest-growing vertical in the last five years, due to regulatory relaxation on sports betting in several markets (US, Canada, Netherlands), a global consolidation in the industry, and fierce competition for leadership in betting apps. The regulatory pendulum has already shifted in one market (the Netherlands) and several other governments may be looking at the social impact of high-frequency betting, which may lead betting brands to consider pre-emptive self-regulation and moderate advertising activity. The lack of a major cyclical sports event in 2023, after the FIFA World Cup 2022, will also slow down the growth of the betting industry.

CPG/FMCG brands behave differently in response to the new challenge and dilemma posed by inflation. Rather than fighting against the down-trading behavior of many consumers through traditional brand campaigns, many brands are instead ramping up their performance spending with Search and Retail Media Networks, as ecommerce sales keep growing for food, drinks, household goods and personal care (from almost nothing pre-COVID). This pivot in CPG marketing comes partly at the expense of traditional branding media (typically: television), but it is mostly funded by reallocating bits of the hundreds of billions of dollars in trade marketing deals between brands and retailers into retailer-controlled media networks (typically: sponsored product search results). CPG brands are thus not really cutting their advertising spending, in fact they are probably growing total ad budgets, but linear media and television budgets are, in many cases, de-prioritized for the time being. But again, CPG brands display a range of strategies across markets, and Food or Drink verticals are actually up in some markets where inflation is slowing down.

AD SPENDING DYNAMIC ACROSS KEY INDUSTRY VERTICALS (2023)

MEDIA OWNERS

CONCENTRATION PAUSES AMONG TOP VENDORS

MAGNA’s analysis of the financial reports of the world’s largest media owners confirm that the level of concentration in the supply side remains high, but the market is more competitive than one or two years ago, thanks to the emergence of challengers in various segments and regions.

The three largest media owners in 2022 (Google, Meta, and Alibaba) captured 47% of global ad spend (across all media and all markets) down from 49% in 2021. That’s because the growth of the top three slowed down to just +4% in 2022 while challengers grew much faster than the Big Three last year in both the Western world (Amazon +21%, Apple +37%) and China (Bytedance/Tiktok +40%, Pinduoduo +42%).

The 20 largest advertising vendors combined captured 72% of the global advertising dollars, which means every other media owner outside the top 20 shared 28% of the world’s advertising spending, compared to 27% in 2021. It’s too early to be sure whether the trend towards globalization and concentration in digital advertising is pausing temporarily, after the tremendous COVID-induced acceleration, or if the market will continue to become more competitive. The first quarter of 2023 suggests the rebalancing continues, with underwhelming growth from the largest vendors and expansion of “small giants”.

Other key finding: the top 20 lists of advertising vendors now includes four ecommerce companies (Alibaba, Amazon, JD.com, Pinduoduo), ten digital media companies (Google, Meta, Apple, Microsoft, Bytedance, Tencent, Baidu, Kuaishou, Twitter, Snap) and just six traditional media companies (Comcast NBCU, Disney, Paramount, Warner Discovery, Fox, and RTL).

KEY FIGURES

TABLE 1: US AD MARKET

Source: MAGNA Global Ad Forecasts, June 2023. Cross-platform, net media owner advertising revenues in billion dollars. By default includes cyclical ad sales (elections, cyclical sports events). PREV: March 2023.

TABLE 2: TOP MARKETS

Source: MAGNA Global Ad Forecasts, June 2023. Media owners net advertising revenues in constant billion dollars. PREV= Previous Global MAGNA update (Dec. 2022)

TABLE 3: GLOBAL AD MARKET

Source: MAGNA Global Ad Forecasts, June 2023. Media owners’ net advertising revenues in billions of constant US dollars. “Traditional Media Owners” include the cross-platform ad revenues of traditional media companies (TV and radio broadcasters, publishers, OOH). “Digital Pure Player” includes the ad sales of digital vendors in search, retail media, social and short-form video. PREV= Previous Global MAGNA forecast (Dec. 2022)

ABOUT THE RESEARCH

The MAGNA market research is media centric. It estimates net media owners advertising revenues based on an analysis of financial reports and data from local trade organizations; other ad market studies are based on tracking ad insertions or consolidating agency billings. The MAGNA approach provides the most accurate and comprehensive picture of the market as it captures total net media owners’ ad revenues coming from national consumer brands’ spending as well as small, local, “direct” advertisers. Forecasts are based on economic outlook and market shares dynamic. The full Ad Forecast report (80 pages) and dataset contains more granular media breakdowns and forecasts to 2027, for 70 markets.

Next Global Forecast: December 2023 – Next US Forecast: September 2023.

ABOUT MAGNA

MAGNA is the leading global media investment and intelligence company. Our trusted insights, proprietary trials offerings, industry-leading negotiation and unparalleled consultative solutions deliver an actionable marketplace advantage for our clients and subscribers.

We are a team of experts driven by results, integrity, and inquisitiveness. We operate across five key competencies, supporting clients and cross-functional teams through partnership, education, accountability, connectivity, and enablement. For more information, please visit our website: https://magnaglobal.com/and follow us on LinkedIn.

MAGNA has set the industry standard for more than 60 years by predicting the future of media value. We publish more than 40 reports per year on audience trends, media spend and market demand as well as ad effectiveness.

To access full reports and databases or to learn more about our market research services, contact [email protected].