Published on The Media Leader

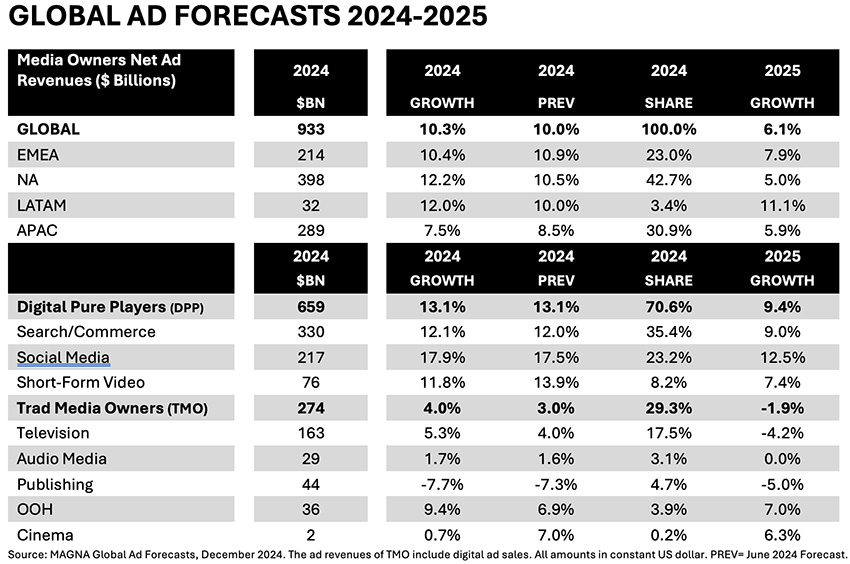

Ad revenue in traditional media — TV, radio, publishing, OOH and cinema — is forecast to grow 4% to reach $274bn globally in 2024, according to Magna.

In the December update to the Global Ad Forecast from the IPG Mediabrands division, this is the best performance in 14 years, discounting the post-Covid-19 bounce of 2021.

Digital ad sales, meanwhile, will increase 13.1% to $659bn, driven by double-digit growth in search/commerce (+12.1%), short-form video (+11.8%) and social media (+17.9%).

Overall, growth in the global ad market has been revised upward marginally to total $933bn in 2024. Magna now expects growth of 10.3%, up from 10% in its mid-year forecast and representing the strongest growth rate in 25 years, excluding the post-Covid recovery of 23% in 2021.

While sporting events played their part in the strong performance in 2024, Magna believes the global market will still grow by 9% with these taken out.

UK remains third-biggest ad market

Noting the growth in real GDP, a slowdown in inflation and several categories (including food, entertainment and retail) upping their adspend, Magna expects the total UK ad market to reach £43.2bn ($54bn) in 2024, up 11.2%.

This means the UK remains the third-largest ad market in the world, behind the US and China.

Traditional media ad revenue is estimated to grow 1.3% to £7.5bn. Cinema and publishing will both decline (by 9% and 3% respectively), but the others are all expected to increase (TV +1%, radio +3% and OOH +11%).

The marginal growth in TV, estimated at £4.2bn, was attributed to 17% increase in non-linear ad sales (ad-supported streaming and broadcaster VOD). Linear ad sales are forecast to be down 3% for the year.

Notably, non-linear accounts for 23% of total TV ad sales – one of the highest proportions in the world, the report noted.

The UK ad market continues to be impacted by inflationary costs, particularly in TV, with the decline in linear TV viewing pushing down impressions, thus driving up CPMs, according to Magna.

That said, both reach and impressions have increased considerably for ad-supported streaming.

Meanwhile, ad revenue for digital players grew by double digits to total £35.7bn — a 13.5% increase.

This was driven by search/retail formats, which were up 12% to £20bn. The fastest-growing category, though, was social media, with revenue increasing 23% to £10bn.

5 key global trends

Globally, Magna reported France and the US showed the strongest growth at 12%, followed by the UK and India (also 11%).

Japan and Canada were next at 8%, then China at 7%.

In the digital space, the big three of Google, Meta and Amazon outperformed the overall market by growing 11%, 22% and 21% respectively during the Q1-Q3 time frame. This gives them a 51% market share of global ad revenue, or 61% excluding China, according to the report.

Magna pointed to five major trends in the ad market in 2024.

First, commerce/retail media continued to drive digital spending, with marketers adjusting where they spend goes as more product categories move from in store to online.

Secondly, ad-supported streaming has boosted long-form video. While Magna pointed to the success from traditional media owners in developing non-linear ad sales, the most significant progress came from ad-supported streaming.

Third, AI is affecting the market in two ways. It is directly supporting ad revenue as tech companies increase their ad budgets to promote their AI-powered products and services. In a less direct way, AI is also being used in the adtech ecosystem to optimise costs and improve programmatic effectiveness, in turn boosting return on investment for advertisers.

Fourth, ecommerce competition has surged, with direct-to-consumer brands such as Temu and Shein upping their adspend, particularly in digital channels.

Finally, Magna pointed to the strong improvement in monetisation of short-form, vertical videos. However, while spend here is not expected to decrease in 2025, with the format now well-established, the report added: “average revenue per ad view is unlikely to increase again at a similar rate”.

2025 slowdown anticipated

In the UK, Magna anticipates further acceleration in real GDP growth as inflation continues to slow, with some of 2024’s growth drivers applying in 2025 as well, such as the rise in retail media and ad-supported streaming.

However, two major headwinds were identified. First, there are fewer major sporting events than in 2024.

Secondly, the roll-out of new regulations regarding TV advertising of foods high in fat, salt or sugar (HFSS) means TV could lose up to 1% of ad sales if brands choose to withdraw advertising instead of pushing it to later in the evening.

Overall, Magna forecasts the UK ad market to slow in growth slightly compared with 2024, increasing by 8.4% to near £47bn.

Traditional ad revenue is expected to be flat, while digital ad revenue growth will slow to 10.2%.

Globally, the market is expected to reach $990bn — an increase of 6.1%. While digital is expected to grow 9%, Magna is forecasting a decline in traditional ad revenue of 2%.