New York, NY – September 16, 2024 – MAGNA U.S. Advertising Forecast Fall Update

Key Findings

- Non-cyclical advertising revenues grew by approx. +11% in the first and second quarter of 2024, in line with MAGNA’s expectations,

- A stronger macro-economic outlook, the momentum of digital media and streaming TV, and the impact of cyclical events, lead MAGNA to raise its second-half ad spend forecast.

- Full-Year non-cyclical ad spend will grow by +8.9% (previously: +8.2%), one of the best performances in twenty years.

- Adding an expected $10 billion in incremental ad revenues due to cyclical events (presidential cycle and summer Olympics) total media owners ad revenues will increase by +11.4% to reach $377 billion this year (MAGNA’s previous forecast: +10.7% in June 2024).

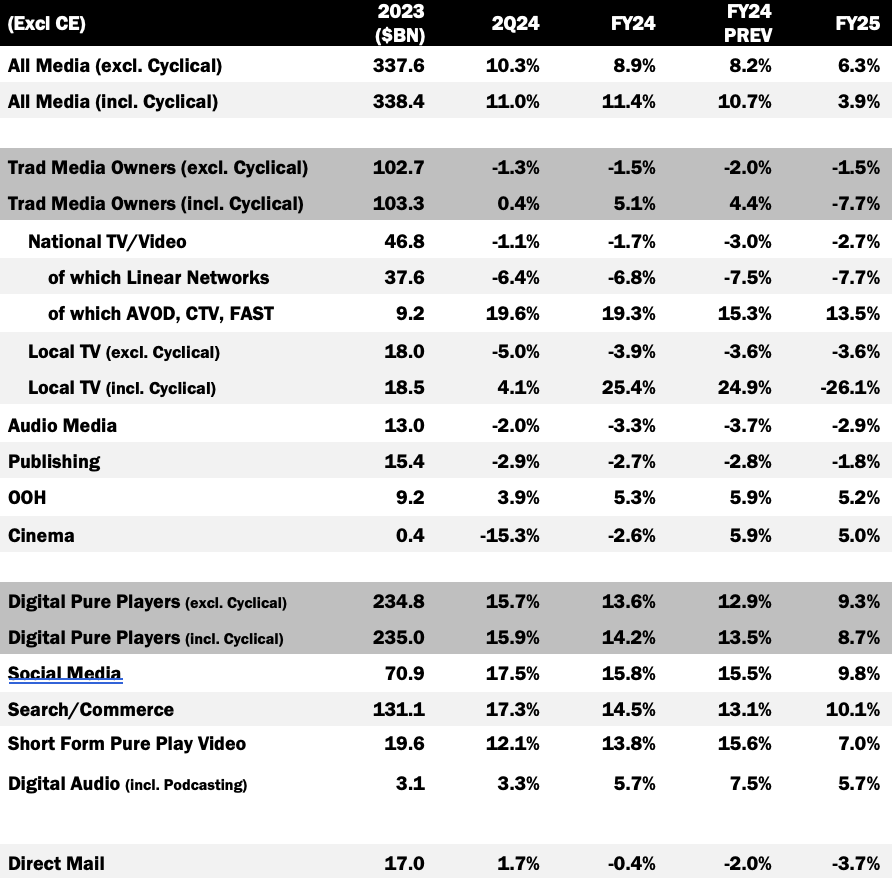

- Digital Pure Players (search, retail, social, and short-form video) capture most of the market growth, with non-cyclical advertising sales to grow by +13.6% to $264 billion (a 72% market share).

- The ad revenues of Traditional Media Owners (cross-platform long-form video, audio, publishing, and out-of-home) will grow by +5.1% to $111bn as the influx of cyclical dollars in TV will more than offset a -1.5% decline in non-cyclical ad sales.

- Ad-funded streaming TV is the fastest growing ad channel this year, with ad spend growing by nearly +20% so far, stabilizing cross-platform TV/video ad revenues.

Vincent Létang, EVP Global Market Intelligence and author of the report, said: “Even without the incremental advertising spending generated around cyclical events, 2024 already looks like a strong year for the US ad market, growing by almost +9%. This is due to strong demand from brands, in a stable economy, and supply-side innovations – e.g., the rise of ad-funded streaming and retail media – offering more scale and return-on-investment to marketers. On top of that, the additional advertising demand generated around Paris Olympics and a re-invigorated presidential campaign will add a record $10 billion of “cyclical” ad sales to bring total media owners ad revenues to an all-time-high of $377 billion.”

AI Tools Help Drive +11% Ad Spend Growth in First Half

Based on MAGNA’s analysis of media companies’ financial reports, total US ad revenues grew by +11.0% year-over-year in the second quarter. That was in line with first quarter, and in line with – slightly stronger – than MAGNA’s projection (+10.4%).

Digital pure players ad sales, rose by approx. +16% YOY, as both Meta and Google credited new AI tools – optimizing content creation or insertion – as driving incremental spending from brands. The Big Three (Meta, Google, Amazon) reported YOY ad sales growth rates ranging +15% to +18% for the quarter. Growth rates slow slightly compared to a peak in 1Q, as anticipated. Media owners provided confident growth guidance for 3Q despite year-over-year comps getting tougher in the second half.

Meanwhile Traditional Media Owners’ sales, excl. cyclical, reached $25 billion in the quarter (-1.3% year-over-year). National video ad sales (on linear TV and long-form streaming) were nearly stable (-1.1% to $11bn), the best performance in two years, as strong growth in ad-funded streaming (nearly +20% driven by the introduction of ads on Prime Video since January) nearly offset the long-term erosion of linear ad sales (-6.4%). Performance among the remaining TMO channels was mixed. Audio ad sales were flat (+0.4% YOY), as digital sales of +6.9% were able to offset broadcast declines of -3.5%. Podcasts were in the high-single-digit- range, and we expect them to remain there for the rest of 2024. Out of home ad revenues were solid at +3.9%. National ad sales continue to lag, while local ad sales are more dynamic. A bright spot this quarter was Direct Mail with a third straight quarter of growth for non-cyclical ad sales (+1.7%). This extends to political ad sales, that nearly doubled in 2Q24 compared to 2020.

In a positive economic environment, several industry verticals showed double digit increases in total advertising spending in the first half including Finance/Insurance (all-media growth +24% YOY) and Automotive (+22%). Technology brands increased ad spend, by +8%, for the first time in years. AI-powered products and services (e.g., Google’s Gemini, Microsoft’s Copilot) may contribute to boosting ad spend as several big tech players seek to dominate a very competitive AI space. Lagging so far this year: Travel (plateauing this year after showing huge growth post COVID) and Pharma (+1% overall but +6% in national TV). Finally, the Olympics boost CPG verticals (esp. drinks and personal care) and again Tech in the third quarter.

Full Year 2024: Strongest Growth in Twenty Years

Economists still expect a solid economy in coming months: full-year real GDP growth will reach +2.6%, inflation will slow down to 2.8%, and unemployment will remain under around 4%. The good macro-economic indicators have not fully translated into increased consumer confidence, however. The Michigan University index stood at 68 in August, which is still below the pre-pandemic average of 85 possibly because of high interest rates and election anxiety. Retail sales have improved lately (+3% YOY in recent months) but brick-and-mortar chains are struggling, while car sales are stagnating, as expected after strong growth in 2023.

With non-cyclical advertising sales already growing by +10.6% in the first half of 2024 (1Q: +10.8%, 2Q: +10.3%), the current attractiveness of the media offering, robust demand from CPG advertisers, and a solid macro-economic outlook, MAGNA is increasing its forecast for second half, non-cyclical ad spend growth to +7.4% (previously: +6.4%). The half-year YOY growth rate was always expected to slow down in the second half of 2024 due to very imbalanced comps in 2023 (weak first half, strong second half).

For the full-year 2024 MAGNA is now expecting advertising revenues to grow by +11.4% to $377bn (+8.9% excluding cyclical). +8.9% would be the strongest non-cyclical growth rate in more than twenty years, if excluding the post-COVID recovery in 2021. To find faster growth we need to look all the way back to the year 2000, when the US ad market rose by +10.8%. This performance is a result of double-digit growth for Digital Pure Players while Traditional Media Owners manage to stabilize ad sales, compared to a mid-single-digit rate of decline in recent years. DPP growth is driven by an acceleration in retail media spending, reallocating marketing budgets and growing the advertising pie, while TMO growth is driven by innovation (e.g., the rapid growth of ad-funding streaming).

Digital Pure Players’ full-year advertising sales will grow by +13.6% to $264 billion (a 72% market share) while the advertising revenues of traditional media owners will grow by +5.1% (as the record influx of cyclical ad dollars offsets a -1.5% decline in non-cyclical ad sales).

Within digital pure players, Search/commerce sales will rise +14.5% to $150bn. Retail media networks will see growth of +20% and near the $50bn ($46bn), which we expect them to surpass next year, while core search (i.e., keyword search) will gain +12% in 2024. Social media sales will rise +15.8% to $82bn, thanks in large part to the AI tools that we mentioned earlier.

Within traditional media owners, non-cyclical national television sales ad will drop on “only” -1.7% to $46bn. Linear ad sales (broadcast and cable networks will fall -6.8% while streaming video sales will grow +19.3% to $11bn and account for nearly 25% of the total market.

Non-political local TV sales will drop -3.9% to $17.3bn but total ad revenue will grow by +25% when including political ad sales. Audio ad sales will rise +1% to $16bn, as a +7% growth in audio streaming and podcasting will offset an erosion -3% in broadcast radio ad sales. Finally, OOH ad revenues will increase by +5.3% to $9.7bn, as we expect the second half ad sales to accelerate thanks to easier comparables.

Cyclical Events Bring in $10bn of Incremental Ad Sales in 2024

Three major cyclical events generate significant additional ad spend and incremental ad sales in 2024: the presidential election cycle, the Summer Olympics and – to a smaller degree – the Copa América soccer tournament, hosted by the US.

Political advertising is by far the largest cyclical booster on even years, and it’s expected to reach new heights this year. MAGNA is forecasting a +11% increase in political ad sales over the previous presidential cycle (2020) to generate a record $9 billion in incremental media owners’ revenues. MAGNA raises its political forecast as Democrat fundraising re-accelerated right after President Biden dropped out of the Presidential race and endorsed VP Kamala Harris. Donations have since flooded into the Harris/Waltz campaign, and total fundraising monitored by the FEC is once again above 2020 levels. A lot of ad spend will again concentrate in a small number of Swing States (Pennsylvania, Michigan, Wisconsin etc.), boosting the ad sales of local television stations and localized digital media. In these battleground states, the extra demand will temporarily squeeze supply and cause raising airtime costs for non-political advertisers.

The other major cyclical event this year was the Paris Olympic games. After the disappointing, COVID-hit Tokyo Games, Paris 2024 brought back the Olympic magic for athletes, fans, and advertisers, with total cross-platform audience delivery up +82% (TAD, source NBCU). For the 17 days of the event, Paris 24 boosted NBCU ratings by +300% vs the same period in 2023, but also brought up overall Primetime TV 18-49 ratings (all networks) by +4%, reversing a year-to-date trend of -14% on the same demographic. Peacock contributed to strong viewing numbers and approx. 13% of total Olympic viewing. With strong ratings freeing up additional ad inventory, NBCU’s total ad sales grew by an estimated +20% vs Tokyo to reach $1.5 billion, of which approx. $400 million generated around digital and streaming properties, and $1.1 billion for linear TV (broadcast and cable networks) (+6%). MAGNA believes that more than 60% of these ad sales will prove net incremental to full-year national TV ad revenues.

2025: Robust Economy and Ad Market, but no Cyclical Events

The advertising market will remain strong in 2025, with non-cyclical ad spend growing +6.3% to $391bn, as the market heads towards $400bn in 2026. However, given the lack of cyclical events in odd-numbered years, total ad sales (incl. cyclical) will rise only +3.9% above 2024. Digital pure players will again drive the market, growing +9.3% to $289bn, while traditional media owners will erode by -1.5% to $102bn. Search/commerce and social media will gain +10%, and the two channels will account for two thirds of all advertising in the country. Most other channels will not perform as well. National television sales will drop -2.7% while local television sales will underperform and decline -3.6%. OOH sales will rise +5.2%, but radio sales will drop -0.8% and publishing sales will decline -1.8%.

The next MAGNA ad forecast (US and Global) will be published early December.

Key Figures

ABOUT MAGNA

MAGNA is the leading global media investment and intelligence company, and part of the IPG Mediabrands network. Our trusted insights, proprietary trials offerings, industry-leading negotiation and unparalleled consultative solutions deliver an actionable marketplace advantage for our clients and subscribers. We are a team of experts driven by results, integrity, and inquisitiveness. We operate across five key competencies, supporting clients and cross-functional teams through partnership, education, accountability, connectivity, and enablement. For more information, please visit our website: https://magnaglobal.com/and follow us on LinkedIn.

ABOUT MAGNA MARKET INTELLIGENCE

MAGNA market intelligence is media centric. It estimates net media owners advertising revenues based on an analysis of financial reports and data from local trade organizations; other ad market studies are based on tracking ad insertions or consolidating agency billings. The MAGNA approach provides the most accurate and comprehensive picture of the market as it captures total net media owners’ ad revenues coming from national consumer brands’ spending as well as small, local, “direct” advertisers. Forecasts are based on economic outlook and market shares dynamic.

MAGNA has set the industry standard for more than 60 years by predicting the future of media value. We publish more than 50 reports per year on ad market trends and media behavior trends.

To access MAGNA reports, insights, and datasets, or to learn more about our market intelligence services, contact [email protected].