TEN TAKEAWAYS

- The winter update of MAGNA’s “Global Ad Forecast” predicts media owners advertising revenues will reach $833 billion in 2023, +5% growth vs. 2022 ($795bn), slowing from +7% in 2022. This new 2023 growth forecast is 1.5 percentage points below MAGNA’s previous forecast (June 2022) due to the deteriorating macroeconomic outlook.

- After a strong start in 2022 (e.g. US 1H: +11%), advertising spending growth slowed significantly in the second half amidst global economic uncertainty (US 2H: +3% excluding political). Nevertheless, full-year 2022 ad revenues still grew by almost +7% to $795 billion, helped by record levels of cyclical spending (elections in Brazil and the US, Winter Olympics, FIFA World Cup).

- Traditional media companies (Television, Audio, Publishing, OOH) saw their advertising revenues grow by +2.5% this year, despite the challenging economic environment, while digital media companies grew by +9%. This the narrowest growth gap ever observed by MAGNA, signaling that editorial media brands remain attractive and relevant as they now combine brand-safety with cross-platform reach.

- Several industry verticals may slow down marketing expenditure in 2023, e.g. CPG/FMCG verticals and Finance. Entertainment, Travel and Betting will continue to be driven by post-COVID recovery and regulatory relaxation. Automotive is a big question mark due to the uncertainty in macroeconomic environment and supply issues, but MAGNA believes ad spend will finally start to recover in 2023.

- In that environment, the ad sales of traditional media owners will slow: Publishing and Television ad sales will shrink by -3% and -4% resp. while Audio advertising will be stable (+1%) and Out-of-Home ad revenues will grow by +6% to reach almost $32 billion, just above pre-COVID total.

- Meanwhile, digital advertising sales will grow by +8% to reach $557 billion dollars i.e. 65% of total ad sales, driven by organic growth factors (ecommerce, media consumption shifts). Digital Video will be the fastest-growing ad format (+11%) followed by Search (+10%), and Social recovering slightly (+7%).

- Television advertising will suffer from continued erosion in linear viewing (-5% to -15% depending on targets and markets), and the lack of cyclical events following the record cyclical spending of 2022, mitigated by resilient pricing (average CPM costs +10%) and growing AVOD ad sales on broadcasters’ streaming platforms.

- The US market growth rate will be below average in 2023 (+4% to $330 billion) due to weak demand (GDP growth under 1%) and the lack of cyclical ad spending. Excluding cyclical/political ad dollars, ad spend will grow by +6% next year as MAGNA expects the market to recover in the second half.

- The second largest ad market, China (15% of global advertising revenues), will re-accelerate in 2023 (+7% to $128 billion) following a historically weak performance in 2022 (+3%) due to the zero COVID policy crippling the economy, and regulatory restrictions slowing down digital media.

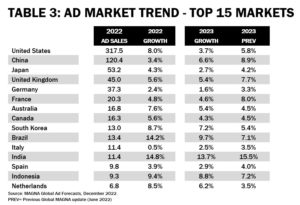

- Among the world’s top 15 advertising markets the strongest 2023 growth will come from India in 2023 (+14%) and South Korea (+7%). At the other end of the spectrum MAGNA expects very little growth (under +3% all-media, negative for traditional media) in Germany, Italy, Japan, and Spain.

Vincent Létang, EVP, Global Market Research at MAGNA and author of the report, said:

Advertising spending slowed down in the second half of 2022 because of economic uncertainty and issues affecting digital advertising formats, but traditional editorial media managed to grow by +2.5%. The gap in growth rates with digital advertising growth (+8.9%) was the narrowest ever measured by MAGNA, suggesting that the long-term transition to a digital-centric marketing landscape has slowed down following the COVID acceleration. Marketers continue to value the brand safety that editorial media vendors deliver, combined with expanding cross-platform opportunities. Television (+2%) and OOH media (+12%) were particularly resilient in 2022. The introduction of ad-supported premium streaming in 2023 and the continued success of digital audio formats also exemplify the comeback of ad-supported editorial media in the top of mind of marketers, consumers, and media executives.

GLOBAL AD FORECAST: +5% IN 2023

MAGNA looks ahead to the new year at a moment of profound uncertainty in the global economy, due to well-known economic and geopolitical factors, and consequently diminished visibility to the short-term trajectory of global media markets. MAGNA nonetheless maintains its usual calendar with this release, and draws confidence in our forward view as we leverage our decades of institutional forecast experience.

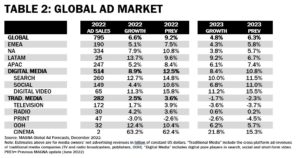

Globally, MAGNA expects media owners’ advertising revenues will grow by +5% in 2023 to reach approx. $830 billion. This is a slowdown from +7% in 2022 and +23% in 2021. The new 2023 growth forecast is 1.5 percentage point below MAGNA’s previous global forecast (published in June 2022) due to a deteriorating macroeconomic outlook. MAGNA’s June forecast was based on a global economic growth expected at the time to reach +3.6% in 2023 (real GDP forecast from IMF WEO April 2022) but that expectation was since cut down to +2.7% in the latest IMF update (WEO October 2022).

Around the global average growth +5% in 2023, MAGNA anticipates few variations as every region is confronted to the same economic challenges. North America and Western Europe will growth below average, growing by +3% to +4%, while APAC (+6%) and Latin America (+9%) will grow slightly faster than average. Among the 15 largest advertising markets, the strongest growth will come from India in 2023 (+14%) followed by South Korea (+7%). At the other end of the spectrum, MAGNA expects very little growth (under +3% all-media, negative for traditional media) in Germany, Italy, Japan, and Spain. France and the UK will find themselves close to the global average, with advertising sales growing +5% to +6% next year.

APAC

APAC media owners advertising revenues grew by +5.2% in 2022 to reach $247bn. With Asian economies expected to re-accelerate and lead the global economy in 2023 (real GDP +4.9%) advertising revenues will accelerate by +6.1% in 2023, as China’s ad market re-accelerates from +3% to +7%. Digital advertising spending reached $169 billion in 2022 (68% of total ad spend). The fastest growth rates in APAC in 2022 came from India (+15%), Malaysia (+13%), and Taiwan (+12%), while ad markets barely grew in Hong Kong (+2%), China (+3%), and Vietnam (+4%). India is now consistently ahead of China as the fastest-growing emerging economy (projected RGDP growth +6.1% in 2023 vs China’s +4.4%) and fastest-growing large ad market (projected growth +14% vs China’s +7%) in 2023, just as it’s about to surpasses China to become the world’s most populous country in 2023.

LATAM

In LATAM, advertising spending reach an estimated $25 billion in 2022 (+14%). The regional economy, already slow in 2022 (GPD +3.5%), will slow down further in 2023 according to the IMF (+1.7%). LATAM advertising revenue growth will therefore slow to +9% which is low historically in a region with high endemic inflation. The sluggish growth in the Brazilian marketplace (+3% in 2022, +1% expected in 2023) weighs on the overall Latin American economy. In 2023, digital advertising formats will again lead the way forward, with spending growing by +15% to reach 55% of total ad spend.

EMEA

The EMEA advertising market grew by +5.1% in 2022 to reach $190 billion, as strong ad spend in the first half was followed a significant slowdown in the second half. The fastest market growth came from Poland (+11%), Sweden (+9%), Netherlands (+9%), and Czech Republic (+8%), while Italy (+1%), Germany (+2%), and Belgium (+3%) showed little or no growth overall.

The EMEA economy is slowing from +3.1% GDP growth in 2022 to just +0.5% in 2023 with a backdrop of higher energy costs and interest rates. Every large market will be affected: the UK (+0.3), France (+0.7%), and Germany (-0.3%). As a result, MAGNA expects traditional media advertising spending to remain subdued, but that will be mitigated by a stabilization in digital media spending. Total ad spend is forecast to grow by +4.9% in the region as digital advertising formats lead the way forward, growing by +7.9% to reach 64% of total ad spend while linear advertising revenues will be flat (up for OOH, flat or down for every other media).

MEDIA TRENDS

TELEVISION RETAINS PRICING POWER

Television continues to suffer from the long-term erosion of linear reach and live viewing (time spent and ratings decreases between -5% to -15% per year depending on targets and markets), still not fully offset by rising audiences and ad sales on non-traditional platforms or formats. Cross-platform television ad revenues grew by +1.7% in 2022 to $172 billion but will decrease by -4% in 2023. To mitigate audience erosion and weaker demand from key industry verticals (CPG, Finance, Pharma), television companies can count on a few strengths and drivers: (1) strong growth for non-conventional ad sales (AVOD, linear addressable +10% to +20% in major markets), (2) resilient pricing (TV CPM inflation hit double-digits in 2021-22 and will continue to grow by an average 10% in 2023), (3) the rise of brand safety and media responsibility in marketers’ priorities that leads some brands to slow down digital diversification, (4) the resilience of sports audiences, compared to other genres. Television is the medium that’s most affected by cyclical ad spend related to elections and global sports events: neutralizing cyclical dollars, global television ad revenues would have been slightly down (-1%) in 2022.

OOH COMPLETES FULL COVID RECOVERY

OOH media has been the success story of 2021 and 2022. At the end of 2022, OOH advertising has already recovered its pre-COVID size in several markets (US, Germany) and MAGNA believes it will complete a full global recovery in 2023 by growing by +6% to 33.5 billion (2019: $33.2 billion). The OOH medium benefits from the recovery of consumer mobility: leisure air travel recovered much faster than expected in 2022 (except in Asia), driving is back to, or above, pre-COVID levels; transit has recovered too but is still 10% to 20% below pre-COVID levels as a significant percentage of workers continue to work from home part of the week.

These long-term drivers explored in great details in MAGNA special report on OOH published in September 2022 (OOH 2022: How OOH Media Survived and Thrives).

AUDIO FUELED BY NEW DIGITAL FORMATS

Audio advertising formats increased ad sales by +4% in 2022 to reach an estimated $29.9 billion, still shy if the pre-COVID total ($31.8bn). MAGNA anticipates flat ad sales in 2023 (+1%) as the continuing rise of digital audio ad formats (audio streaming and podcasting) barely offset a slowdown in broadcast radio revenues.

The growth in digital audio ad sales comes from digital pure players as well as radio broadcasters developing their on-demand and streaming offering and attracting more and more brands thanks to improved targeting opportunities.

PUBLISHING AD SALES SUFFER FROM PRIVACY LIMITATIONS

Publishing advertising sales shrank by -3% in 2022 to $47 billion. Both newspaper brands (-3%) and magazine brands (-4%) suffered as the growth in digital ad sales did not offset the long-term decline of print ad pages and revenues.

Publishers’ digital ad sales are hurt by the limitations in data collection and data-based targeting online in both the browser and the app environment since iOS 14. MAGNA predicts another decline of -3% for global publishing ad sales in 2023.

SEARCH: RECESSION-PROOF, PRIVACY-PROOF

Keyword-based search advertising formats (including product search by ecommerce platforms) remain the largest advertising format with consumer brands and small businesses spending $260bn in 2022 globally. While the growth of other digital ad formats slows due to data restrictions, Search is driven by the continuing growth in ecommerce and Retail Media Networks and was the fastest-growing ad format in 2022 (+13%).

Growth was fueled by volume rather than pricing: search queries increased by +3% and click-through-rates (% of search results leading to sponsored link clicks) increased by +9% probably because an increasing proportion of searches are product or shopping searches. The same organic growth factors will generate an additional +10% in global Search spend in 2023.

For more information about Search and Retail Media, please refer to MAGNA’s deep dive report, Search 2022 published in October 2022 in partnership with REPRISE.

SOCIAL MEDIA: AD SALES STALLING UNDER A STORM OF HEADWINDS

Multiple headwinds (plateauing reach and usage, brand safety concerns, targeting limitations, and the rise of video snacking hurting both insertions and pricing) combined to cause social media advertising revenue to stall in 2022. Global ad sales grew by just +4% to $149 billion, a far cry from the growth rates of 20% to 35% observed in the previous three years. Tiktok is the only social media owner to post advertising growth, while incumbent social networks suffer flat or declining ad sales, especially in Europe and North America. MAGNA anticipates social media advertising to re-accelerate only slightly in 2023 (+7%). For more insight on Social Media trend, refer to MAGNA’s report, Social 2022 published in December 2022 in partnership with REPRISE.

DIGITAL VIDEO: CONTINUED ROBUST GROWTH

Digital Video advertising will increase by +11% in 2022 to reach $65 billion. This represents the second fastest growth rate of all digital formats, slightly trailing search advertising. All components of the digital video landscape continue to grow, but short form user generated content (YouTube, Twitch, etc.) have seen slowing growth this year. CTV usage and streaming consumption continues to be a tailwind for long-form streaming growth, and 2022 has been no exception.

MEDIA OWNERS: DIGITAL CONCENTRATION PAUSES

The digital media giants saw slower growth in 2022 than they have in recent years. Based on financial publications in the first three quarters, MAGNA expects the top three (Google, Meta, Alibaba grew net advertising revenues by a combined +5% in 2022 (compared to +41% in 2021!), i.e. they underperform overall market growth (+6.6%) for the first time ever and their share of global ad sales paused at 42% after rising sharply and constantly in the last 15 years. Meanwhile, other top 15 media owners, Amazon, Bytedance, Microsoft and Apple continued to enjoy double-digit stronger growth in 2022.

FOCUS ON THE US MARKET

The US economy has been sluggish for most of the year, even before the Ukraine war, and will remain slow through at least mid-2023 (FY GDP growth +0.7%), while consumer confidence has hit a 20-year low (index 55) and inflation a 40-year high (8%). On the bright side, the job market is expected to hold next year (unemployment 4.2%) and inflation is expected to slow to just +3%.

In that environment, MAGNA is expecting several industry verticals and product categories to show flat or decreasing advertising spending in 2023: CPG and Finance will be among the verticals most negatively affected. Entertainment/Media, Travel and Betting will continue to grow under organic factors, while Automotive may finally grow again as supply issues gradually improve.

Meanwhile, political advertising spending grew by +66% over the previous mid-terms, to generate $7.4bn in net incremental advertising revenues for media owners ($5.2bn for local TV groups, $1.1bn for digital media formats, etc).

The US ad market lagged the economic cycle in 2022. Advertising spending kept growing in the first half, driven by the post-COVID momentum on consumer spending and mobility and the systemic lag created by the upfront media buying deals, while the US economy stalled into a “technical recession”: two consecutive quarters of (shallow) negative GDP growth. The economy re-accelerated in 3Q22 (GDP +2.6%), but that’s when ad spend stalled. Advertising revenues grew by +11% year-over-year in the first half of 2022 but slowed to just +6% in the second half. Half of that second-half growth came from political advertising; in other terms, non-political, non-cyclical advertising grew by just +3% in the second half over the same period of 2021.

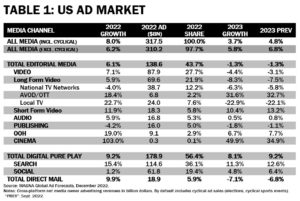

On a full-year basis, the advertising market grew by +8% in 2022 to reach $318bn. Excluding cyclical spending around the 2022 mid-term elections, the Winter Olympics, and FIFA World Cup, the market growth would have been +6%.

Looking at key media types, total video advertising sales gained +7% in 2022, with national long-form video down -1% (linear national TV -4%, AVOD ad sales +18%), while local video gained +23% due to the impact of mid-term elections, and short form video (YouTube, Twitch) rose by +12%. Audio ad sales were up +5%, boosted by a +15% performance in streaming and podcasting ad sales. Cross-platform publishing ad sales dropped -4% as a -14% decline in papers was more than enough to offset the +5% growth in digital sales. OOH sales increased by an estimated +19% to reach $9.1 billion and surpass its pre-COVID market size, driven digital OOH ad units (+26%) and the belated recovery of the Transit segment (+60%). Although Cinema advertising doubled from 2021 as moviegoers returned to theaters to welcome the comeback of blockbusters like Top Gun: Maverick and Black Panther: Wakanda Forever, theater attendance and advertising sales remain -35% and -50% below pre-COVID levels resp.

Looking at digital ad formats, social media advertising crawled to a sudden halt in 2022, +1% to $62bn, compared to +38% in 2021, because of audience plateauing, pricing power that was hurt by the post-iOS 14 environment, and the rise of video snacking as a major consumption pattern. Search continues to be driven by the growth of ecommerce and is unaffected by the data privacy issues curbing the growth of display and social formats, with advertising sales growing +15% to $115 billion (largest ad formats with 36% of total ad dollars this year).

For 2023, MAGNA now anticipates total ad spend to grow by +3.7%, one percentage point below the previous US forecast (Sept. 2022). Excluding cyclical ad sales in ‘22 and ‘23, growth in 2023 will be +5.8% i.e. barely below 2022 (+6.2%). Long-form video advertising will shrink by -8% as the lack of political spending will not be offset by the continued growth of broadcaster AVOD +32% and short-form video (+10%). OOH will continue to outperform (+7%) while audio and publishing formats will essentially stabilize. Search will remain strong (+11%) while social media ad sales will grow again but far slower than pre-iOS 14 growth rates (+5%).

KEY FIGURES

ABOUT THE RESEARCH

The MAGNA research is media centric. It monitors net media owners advertising revenues based on a bottom-up analysis of financial reports and data from media trade organizations; other ad market studies are based on tracking ad insertions or consolidating agency billings. The MAGNA approach provides the most accurate and comprehensive picture of the market as it captures total net media owners’ ad revenues coming from national consumer brands’ spending as well as small, local, “direct” advertisers. Forecasts are based on economic outlook and market shares dynamic.

The full Ad Forecast report (70 pages) and dataset contains more granular media breakdowns and forecasts to 2027, for 70 markets.

Next Global Forecast: June 2023 – Next US Forecast: March 2023.

ABOUT MAGNA

MAGNA is the leading global media investment and intelligence company. Our trusted insights, proprietary trials offerings, industry-leading negotiation and unparalleled consultative solutions deliver an actionable marketplace advantage for our clients and subscribers.

We are a team of experts driven by results, integrity and inquisitiveness. We operate across five key competencies, supporting clients and cross-functional teams through partnership, education, accountability, connectivity and enablement. For more information, please visit our website: https://magnaglobal.com/and follow us on LinkedIn and Twitter.

MAGNA has set the industry standard for more than 60 years by predicting the future of media value. We publish more than 40 reports per year on audience trends, media spend and market demand as well as ad effectiveness.

To access full reports and databases or to learn more about our market research services, contact [email protected].