KEY FINDINGS

- U.S. media owners advertising revenues grew by a decent +6% in 2022 (excluding cyclical ad spend) to reach $315bn. However, ad spend slowed down significantly through the second half, and fourth quarter ad sales were flat year-over-year.

- Looking at 2023, there are mixed economic signals (slow but continued GDP growth, receding inflation, resilient job market) while financial turbulence is generating anxiety among consumers and businesses.

- On the other hand, the rise of retail media networks, the growth of ad-supported video streaming and the recovery of the automotive industry are among organic growth factors mitigating the impact of macro-economic uncertainty.

- Looking at key industry verticals, Automotive has finally turned a corner in 2023. Car sales have started to grow again, and media owners already saw a rebound in ad spend in the fourth quarter. Travel and Entertainment will also grow ad spending in 2023, while CPG, Restaurants and Retail brands might struggle.

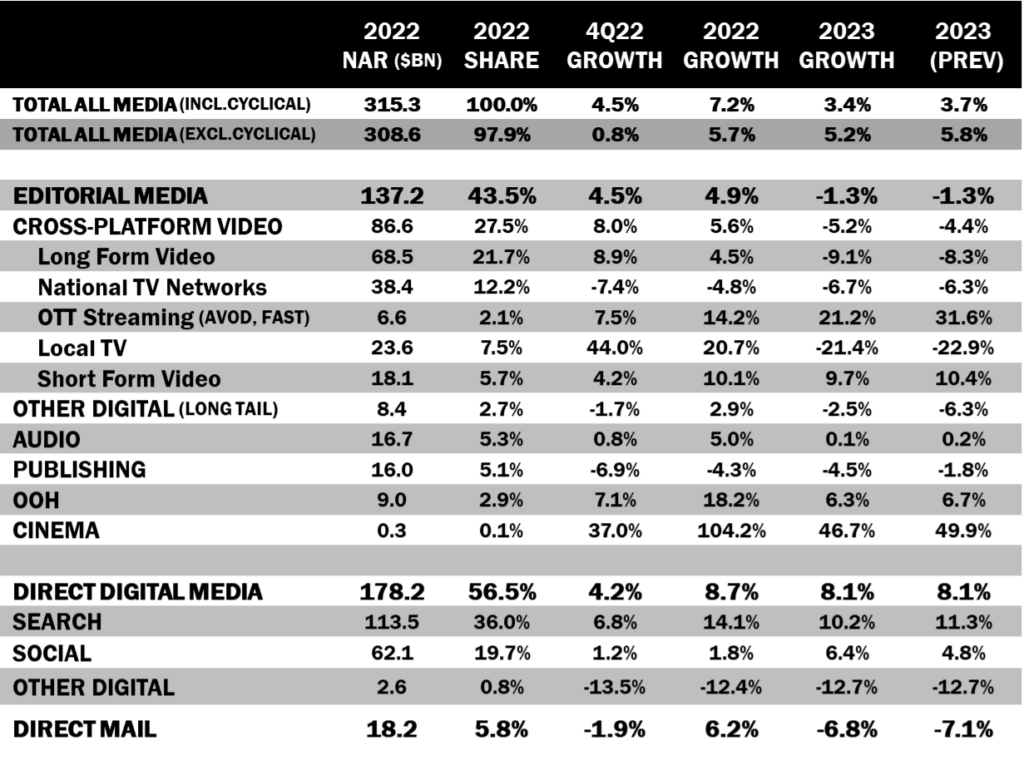

- As a result, and on balance, MAGNA anticipates all-media ad revenues to increase by +3.4% this year (compared to +3.7% in previous forecasts) as the market grows to a new all-time high of $326 billion. Neutralizing cyclical events in 2022 and 2023, non-cyclical advertising spend (excluding political and Olympic) will grow by +5.2% this year.

- Digital advertising will continue to grow (+9%), driven by organic adoption while linear advertising formats, more vulnerable to the uncertain economic environment, will erode by -4%.

- Search and Product Search will remain the largest ad formats for brands, growing by +10% to $125bn in 2023. National long form video (linear TV and streaming) will stabilize around $44bn, as growth in OTT ad sales will offset the decline of linear TV.

Vincent Létang, EVP, Global Market Research at MAGNA, and author of the report, said: “In a similar economic climate, ten or twenty years ago, the U.S. advertising market would almost certainly fall off a cliff. Things are different in 2023 because of media innovation fueling marketing demand. The organic drivers that boosted the ad market in 2021 and the first half of 2022 are still around and mitigating the impact of stressful economic signals. Such organic drivers include the rise of retail media networks which are redirecting billions of marketing budgets dollars into advertising formats. In addition, with long-form OTT streaming going mainstream and increasingly ad-supported, brands finally find cost-effective solutions to reconnect with audiences that had become hard and expensive to reach through linear television. These are some of the reasons why advertising spending continued to grow in the second half of 2022, despite economic uncertainty, war, inflation, and very high growth comps. For the same reasons, MAGNA expects advertising activity to continue to grow, albeit at a slower pace, in 2023. An additional growth factor for 2023 is the recovery of the automotive market, a top five vertical for most media types in America”.

2022: DECENT YEAR BUT AD MARKET STALLED IN SECOND HALF

Based on MAGNA analysis of media companies’ fourth quarter earnings, the U.S. advertising market continued to slow down in 4Q22. The slowdown was slightly stronger than expected, as ad spend was essentially flat (+0.8% year-over-year) in the quarter. We must keep in mind that we are comparing with 2021, a post-COVID year that was the strongest ever, both in terms of dollar spend and year-over-year growth; with such high comps MAGNA was always expecting a significant slowdown following this abnormal year of growth.

On a full-year basis, the U.S. ad market grew by +5.7% in 2022, excluding cyclical advertising. Including these cyclical dollars (political and cyclical sports events), it grew by +7.2% to reach a new all-time high of $315 billion.

2023: MIXED MACRO-ECONOMIC SIGNALS

Looking at the economic environment, concerns about the financial system are grabbing headlines in recent weeks, but the economic fundamentals are stronger than 2008 or 2020, and several indicators have in fact stabilized or improved in the last few months. For instance, in the latest update of the “Survey of Professional Forecasters” (February), economists slightly raised GDP growth expectations for 2023, after four or five downwards revisions in previous quarterly reports. Real GDP growth of +1.3% in 2023 remains slow, but it was raised from +0.7% after the better-than-expected performance in 3Q22 and 4Q22 (around +3%) showed the resilience of the U.S. economy against the global slowdown. Despite modest GDP growth, economists are anticipating unemployment to remain below 4% in 2023. With food inflation slowing down, gas prices back to pre-Ukraine levels, and unemployment remaining low, the consumer confidence index has recovered from its all-time low of 50 in June 2022, to reach 57 in November, and 67 in February. However, 67 is still low by historical standards; consumers and marketers are likely to get nervous and cautious again following the recent turbulence in the banking system and stock market.

Consumer inflation has slowed down significantly since the June 2022 peak (around 9%), although the decrease is mostly due to the slowdown in energy and food prices. “Core” inflation, that excludes food and energy, remained close to 6% in January, but economists still expect it to slow down to 3% by the end of the year, which means there’s little fear of a return the endemic inflation experienced in the 1970s, and the brutal interest rate remedies required to curb it back then. Finally, corporate America remains healthy, with profitability and debt sustainability ratios which both remain strong, suggesting the large businesses that own consumer brands can keep investing in marketing through any future economic slowdown.

MARKETING ACTIVITY IN UNCERTAIN TIMES

Marketing activity and advertising spending are typically vulnerable in times of economic slowdown and low visibility. CPG verticals, which are normally largely immune to declining sales, were hit by inflation and supply issues in 2022. On top of that, there are no cyclical events in 2023, no elections and no major international sports events. That’s about seven billion dollars of cyclical ad spend in even-numbered years (approx. 1.5 percentage point of incremental ad sales) which doesn’t exist in 2023, since very little of that money carries over to odd-numbered years like 2023.

But there are still some drivers to marketing and advertising activity, mitigating the impact of economic slowdown. Consumption and retail sales will be supported by inflation cooling down, and supply chain issues going away gradually. We can already see the automotive market bouncing back despite high interest rates and consumer anxiety. Some other industry verticals will continue to benefit from post-COVID lifestyle recoveries including travel and movie going.

Another resilient factor identified by MAGNA is the fresh memory of 2020 in the marketing community, when some brands over-reacted by cutting their advertising presence massively, losing share of voice and ultimately market share. Some other brands, by simply maintaining their advertising budgets through the crisis, raised their profile and increased their market share when business re-started a few months later. As media cost inflation is currently slowing down and stands typically below general inflation rates, we suspect many marketers will see an opportunity to improve return on investment. In linear national television, for instance, the media cost to reach a thousand viewers with a commercial rose by an average of 10% per year pre-COVID (when general inflation was 2%) to reach more than $70 in 2022; in 2023 MAGNA anticipates the cost to level for the first time in fifteen years (averaging +3% to +4%), making television relatively more affordable to brands.

Finally, ad market growth continues to be fueled by organic media technology innovation which funnels marketing budgets into advertising formats. Brands and marketers are faced with increasingly attractive opportunities to reach consumers in scalable, addressable, yet safe media environments, in cost-effective ways. For instance, ad-supported long-form video streaming is expanding with the launch of ad tiers from Disney+ and Netflix (AVOD, FAST channels), allowing brands to reconnect with demographics that are increasingly hard and expensive to reach through linear television. Another example is the growth of retail media networks, channeling below-the-line marketing budgets into digital media. As e-commerce takes off in many CPG segments, deals between brands and retailers lead to gradual budget reallocation from in-store marketing into retail media networks. Retail media advertising revenues will grow by +15% to reach $41 billion in 2023.

INDUSTRY VERTICALS: THE GRAND AUTO COMEBACK

In this economic environment, MAGNA expects several industry verticals to slow or cut advertising spending. CPG sectors, Food Drinks, Retail and Restaurants may see little or no growth (decreasing spending in linear media, low single-digit growth overall). In the Finance sector, banking, credit cards and the mortgage segments are suffering but the largest segment, Insurance, should recover after a poor 2022, bringing the vertical to moderate growth (+5%). On the other hand, Travel and Movies will continue their post-COVID recovery and Streaming is more competitive than ever, with Disney+ and Netflix now aiming to scale up no just subscribers but also viewers and advertising revenues. All these verticals will continue to grow marketing spending in 2023.

But the big news is the recovery of the Automotive market which will bring back automotive marketing and advertising activity. Despite the economic slowdown and low consumer sentiment, car sales have already started to recover in the second half of 2022, and MAGNA anticipates car sales will grow by approx. +10% in 2023, as they already have since October 2022 year-over-year. This will likely lead to a +10% to +15% increase in advertising spending by car dealers (already the largest non-political vertical for local television, with 25% of total ad sales pre-COVID) and car brands (seventh largest vertical for national TV, fifth largest for digital media).

The reason behind Automotive’s counter-cyclical pattern is of course the delay in its usual market cycle caused by the supply chain crisis between mid-2021 and mid-2022. Automotive manufacturers were deprived of the sales recovery that most other industries experienced over that period. Now that inventory is recovering and price increases have slowed down, millions of households will finally be able to replace their old cars, crowding websites and dealerships; brands and dealers thus need to ramp up marketing and advertising channels to compete to attract them. Brands and dealers can no longer assume consumers will be as loyal as they were pre-COVID and pre-Electric. The accelerating transition to electric vehicles – increasingly affordable and available in almost every brand and car segment – is opening competition, and all manufacturers (generalists and electric specialists) must scale up their marketing and advertising efforts to maintain their share of voice and intent looking forward.

ADVERTISING REVENUE TO SHOW MODEST GROWTH IN 2023

With a mixed macro-economic and business environment, but some resilient verticals and organic growth drivers, MAGNA on balance maintains its prediction of advertising growth in 2023, with only a marginal reduction in the growth rate forecast.

In its new 2023 scenario, MAGNA expects little or no growth in the first half (+2% in 1Q23, +4% in 2Q23) against tough quarterly comps, followed by a recovery in the second half (+6% to +7%), as the economy solidifies, and advertising comps become much easier. Overall, full-year advertising revenues will grow by +3.4% this year to reach $326 billion (incl. CE).

In terms of media advertising revenues, some channels will perform better. Search and e-commerce advertising formats (Google, Amazon, retail media networks) will continue to be driven by the expansion of e-commerce to CPG and grow by +10% (slowing down from +14% in 2022) to remain the largest advertising format ($125bn in 2023). Social media formats (Facebook, Instagram, Tiktok …) will re-accelerate +6% to $66bn after stalling in 2022 (+2%) due to headwinds including audience maturity and the data targeting limitations established in 2021.

Cross-platform national long-form video advertising (linear TV networks, AVOD and FAST channels) will stabilize overall (-1% to $43.8bn) as the organic growth of streaming (AVOD and FAST channels) (+20%) roughly offsets the organic decline and weaker pricing of linear ad sales (-5%). Local television may struggle with non-political ad sales down -5% and total ad revenues might shrink by -24% due to the lack of political spending, after record sales in 2022.

Cross-platform audio ad sales will stabilize around $17 billion this year. Linear radio ad formats will drop -4%, while digital audio formats (audio streaming, podcasting) will rise +9%. Podcasting will help drive digital audio growth, and grow +16%, though this represents a slowdown compared to MAGNA’s previous forecast of +22%, as the channel has not been immune to the general advertising market slowdown, despite continued interest and adoption. Publishing ad sales will fall -5% to $15 billion. Loyalty from endemic spending verticals like luxury and growth in digital ad sales (+4%) may not be enough to offset the continued decline in printed ads. Out-of-home will continue to outperform other traditional media channels in 2023 (+6% to $9.6bn), thanks to digital and programmatic innovations creating new opportunities for national brands, and the resilience of local businesses that contribute to half the OOH ad sales (e.g., car dealers).

Finally, direct mail sales will fall by -4% to $16.8bn in 2023, or -7% including the impact of political spending (which was more than $700m in 2022). A number of price increases were implemented during 2022 in an attempt to keep pace with inflation, and the channel saw growth for three of the four quarters before finally declining in 4Q22 (-8%). Another price increase was implemented in January, which should help mitigate the impact of lower volume, as mail has been impacted by the advertising market slowdown, like many channels have been.

ABOUT THE RESEARCH

The MAGNA research is media centric. It monitors net media owners advertising revenues based on a bottom-up analysis of financial reports and data from media trade organizations; other ad market studies are based on tracking ad insertions or consolidating agency billings. The MAGNA approach provides the most accurate and comprehensive picture of the market as it captures total net media owners’ ad revenues coming from national consumer brands’ spending as well as small, local, “direct” advertisers. Forecasts are based on economic outlook and market shares dynamic.

The full Ad Forecast report (70 pages) and dataset contains more granular media breakdowns and forecasts to 2027, for 70 markets.

The next MAGNA ad forecast (U.S. & Global) will be published in June 2023.

ABOUT MAGNA

MAGNA is the leading global media investment and intelligence company. Our trusted insights, proprietary trials offerings, industry-leading negotiation and unparalleled consultative solutions deliver an actionable marketplace advantage for our clients and subscribers.

We are a team of experts driven by results, integrity and inquisitiveness. We operate across five key competencies, supporting clients and cross-functional teams through partnership, education, accountability, connectivity, and enablement. For more information, please visit our website: https://magnaglobal.com/and follow us on LinkedIn.

MAGNA has set the industry standard for more than 60 years by predicting the future of media value. We publish more than 40 reports per year on audience trends, media spend and market demand as well as ad effectiveness.

To access full reports and databases or to learn more about our market research services, contact [email protected].

U.S. MEDIA OWNERS NET ADVERTISING FORECASTS (NAR)

Source: MAGNA March 2023 based on financial reports.

“Cyclical” refers to incremental ad revenues generated around elections and major international sports events (Olympics, FIFA).